- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- How do I force ProConnect to refund the entire overpayment on a Form 1040-SR. In the application of overpayment drop-down menu, there is no such option.

How do I force ProConnect to refund the entire overpayment on a Form 1040-SR. In the application of overpayment drop-down menu, there is no such option.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

By default, PTO refunds the entire overpayment. In other words, there is nothing to force.

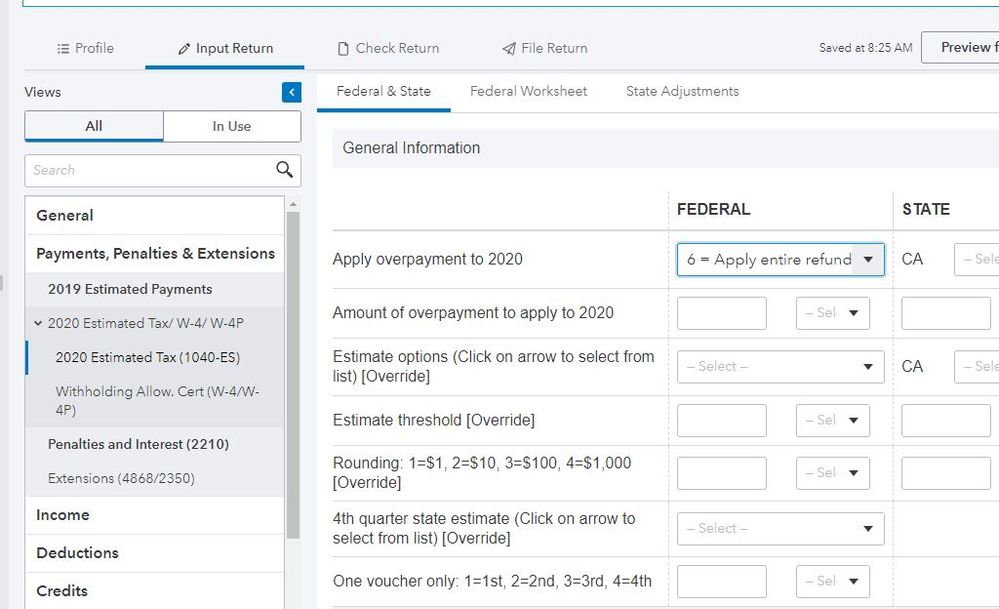

The screen that you and George referred to is applicable when you want a portion of or the entire overpayment applied to 2020 ES-tax. If you have entered anything on that screen on the line for Apply overpayment to 2020, remove them and the overpayment will be refunded in full.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There are TWO choices #6 and #7

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Someone replied that options 6 and 7 both specify a refund of the overpayment, but that is not correct.

Option 6 says "Apply entire refund, estimates if necessary"

Option 7 says, "Apply entire refund, no estimates"

There is no option to "Refund entire overpayment"

I am using option 7, and also specifying in the line below ("Amount to apply to 2020) that 0 is to be applied, but ProConnect is still applying 100% of the overpayment to 2020, and refunding none.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

By default, PTO refunds the entire overpayment. In other words, there is nothing to force.

The screen that you and George referred to is applicable when you want a portion of or the entire overpayment applied to 2020 ES-tax. If you have entered anything on that screen on the line for Apply overpayment to 2020, remove them and the overpayment will be refunded in full.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Please ignore my post and listen to the master that says delete any choice in that section.

Answers are easy. Questions are hard!