- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Entering tax on a missed RMD in ProConnect

Entering tax on a missed RMD in ProConnect

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I enter tax on a missed RMD on form 5329 (Part IX - Additional Tax on Excess Accumulation in Qualified Retirement Plans). It only allows entries for calculating Part I of that form. I'm accessing the form through the 1099-R input screen. Is there an additional location for this entry or will that form need to be completed manually?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, but I'm pretty sure this part of the form should be completed and sent with a statement requesting a waiver.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I've always requested a waiver of the total amount, and ProSeries has always filled out the form as the instructions require. Your results may vary with ProConnect, although I doubt it.

Waiver of tax for reasonable cause. The IRS can waive part

or all of this tax if you can show that any shortfall in the amount

of distributions was due to reasonable error and you are taking

reasonable steps to remedy the shortfall. If you believe you

qualify for this relief, attach a statement of explanation and file

Form 5329 as follows.

1. Complete lines 52 and 53 as instructed.

2. Enter “RC” and the amount of the shortfall you want

waived in parentheses on the dotted line next to line 54. Subtract

this amount from the total shortfall you figured without regard to

the waiver, and enter the result on line 54.

3. Complete line 55 as instructed. You must pay any tax due

that is reported on line 55.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

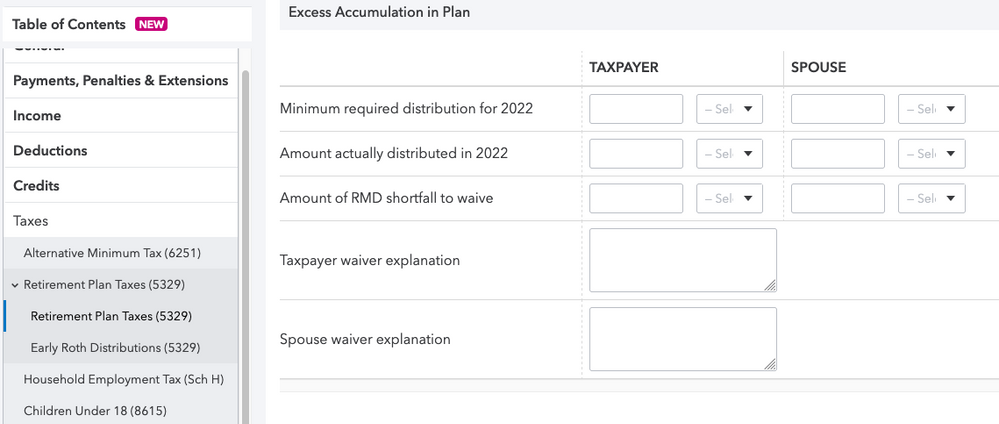

Entries for Part IX, including RMD shortfall waivers, are on the Taxes > Retirement Plan Taxes (5329) screen: