- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- 8829 Home Office - Business Percentage - 10x on Depreciation Form?

8829 Home Office - Business Percentage - 10x on Depreciation Form?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I've transitioned from ProSeries 2020 to ProConnect for 2021.

2019 8829 inputs:

2020 8829 inputs:

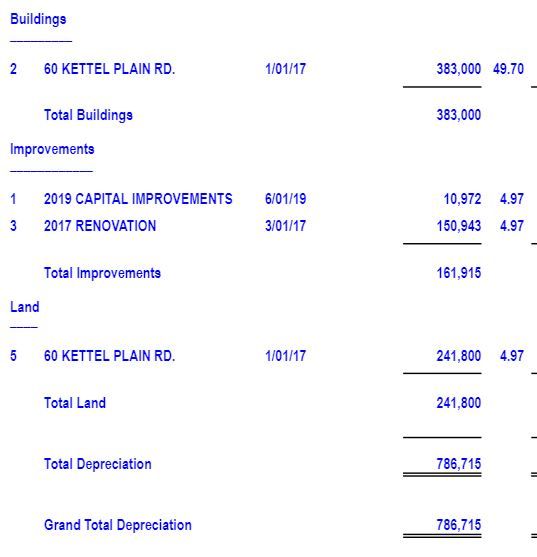

2019 Depreciation Report includes the home, date of service, basis, land value, and business %:

4.97% x $383200 = $19,045

But the 2020 Depreciation Report looks like this:

Inputs are all the same, but the Depreciation Report says 49.70% business use, rather than 4.97% - depreciable basis is calculating as $190,351, rather than $19,045.

All the other depreciable assets related to 8829 are reflecting the 4.97%:

Can anyone explain to me what is going on here, or how to rectify this??? I can reduce the business basis by 10x, since they're calculating a 10x on the business percentage - but I really want to understand why.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Use chat to get a support person to look at the detail of input.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Chat? I thought that was extinct.

EDIT: Oh we're in PTO. I guess they still have it as the only option.

The more I know the more I don’t know.