- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Why did Lacerte tax away the input box for K1 1041 Long Term Capital Gain State Amount IN A 1040? It was there in 2017, gone since.

Why did Lacerte tax away the input box for K1 1041 Long Term Capital Gain State Amount IN A 1040? It was there in 2017, gone since.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

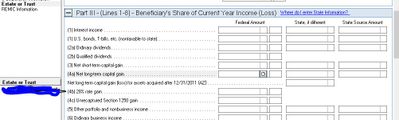

Why did Lacerte tax away the input box for K1 1041 Long Term Capital Gain State Amount IN A 1040? It was there in 2017, gone since. I don't do a lot of Trust Returns, but it seems this type of inconsistentcy is resulting in all sorts of errors for tax people to reconcile, spending hours trying to figure out what should be a simple data input, especially with new input staff. Yes, the solution is to input state Long Term Capital Gain into Short Term (for California), and other manual adjustments for other states. For the price we pay, this is ridiculous. I would like to know WHY Lacerte took the input box away and 3 years later HAS REFUSED to solve this issue.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It does seem to be there for those states where the resident state is one of the few states that treat long term different from short form.

e.g. AZ

Answers are easy. Questions are hard!