- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When entering the sale of a personal residence, I enter "Expenses of sale...", but this amount does not show up in the forms as either an adjustment to the sales price or a Form 8949 column g adjustment. Any ideas on what I may be doing wrong? Thank you.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

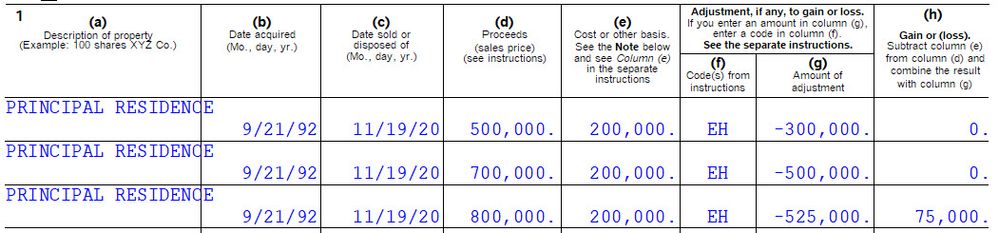

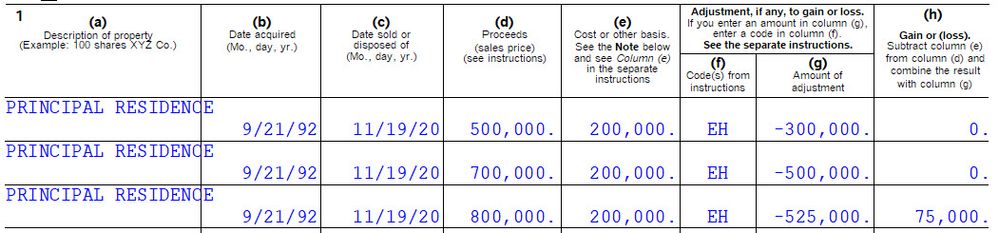

Here is how Lacerte calculates Column (g).

- First, it calculates Column (d) – Column (e).

- Then, it compares the difference in Step 1 to the home-sale gain exclusion for the filing status.

- If the difference is less than or equal to the applicable gain, it does not add the selling expenses to Column (g).

- If the difference is more than the applicable gain, it does add the selling expenses to Column (g).

Example: A married couple sells a home in 2020 with a cost basis of $200,000, incurring $25,000 in selling expenses. The couple qualifies for the full Sec. 121 exclusion. The following screenshot shows the effect of selling price on Columns (g) and (h).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is it being added to the basis?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No, it is not added to the basis.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Here is how Lacerte calculates Column (g).

- First, it calculates Column (d) – Column (e).

- Then, it compares the difference in Step 1 to the home-sale gain exclusion for the filing status.

- If the difference is less than or equal to the applicable gain, it does not add the selling expenses to Column (g).

- If the difference is more than the applicable gain, it does add the selling expenses to Column (g).

Example: A married couple sells a home in 2020 with a cost basis of $200,000, incurring $25,000 in selling expenses. The couple qualifies for the full Sec. 121 exclusion. The following screenshot shows the effect of selling price on Columns (g) and (h).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

PKCPAMST, Thank you for taking the time to provide such a complete and understandable reply. I'm new to Lacerte and find issues like this to be quite frustrating. Aside from going to the message boards, is there a user guide that I can search for answers to my questions? Thanks again, Dave

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"is there a user guide that I can search for answers to my questions?"

Google:

home sale lacerte

And find in your results:

Google works better than the search here, such as:

https://proconnect.intuit.com/community/help-articles/help/02/101

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Dave,

Thanks for the kind words.

I have been using Lacerte software since the mid-1980s, well before Intuit bought the software in 1998 from Larry Lacerte for $400 million. When I was working on my masters in tax law back in the late 1980s, the professor who taught gift and estate tax class said something that I never forgot.

He said the tax laws are esoteric. I can say the same for the tax software.

The best teacher in life is experience. In the meantime, keep asking questions on this forum. There are some wonderful folks here who are eager to help. After all, knowledge is meant to be shared.

PK

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"He said the tax laws are esoteric."

My father was a Lacerte user back in the olden days.

He told me, "There is a reason they call them Law Practice, Tax Practice, Accounting Practice, Medical Practice...It's **bleep** near impossible to get it Perfect."

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Your father was absolutely right!

When the class would have difficulty understanding a particular section of the Internal Revenue Code, another law professor used to remind us there's a reason why it's called the code.