- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: ladies who are still... well, err....Need your advice

ladies who are still... well, err....Need your advice

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Dear ladies of all types, sizes, ages, personalities, religions, etc etc.

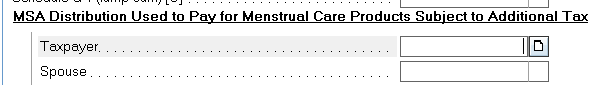

See the snip. As a male, with limited experience in the subject, how should I raise the subject of menstrual care products and taxes? Answer: Delicately. But how do I avoid offending those who might appear not to need them? I say might. (Again, limited experience - no daughters and a wife I married late in life.) I am not one to judge based on appearance. I suppose my policy should be to ask all female clients without discrimination about menstrual care products.

Any advice from the ladies?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

something like......... as a participant of an MSA account the government has a unique provision that requires me to ask an awkward question........

and you ask everyone.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"I suppose my policy should be to ask all female clients without discrimination about menstrual care products."

Ask everyone, if it's a provision (MSA) that applies to them. Don't you have a questionnaire? Focus on the MSA first, to avoid unnecessary queries. But then, you ask everyone. Not just female-in-appearance and young-adultish. The IRS explains qualified spending by any party:

https://www.irs.gov/instructions/i8853#en_US_2023_publink24188ld0e1123

"Qualified medical expenses are those incurred by the account holder or the account holder's spouse or dependent(s). Amounts paid for menstrual care products shall be treated as paid for medical care."

"Line 7

In general, include on line 7 distributions from all Archer MSAs in 2023 that were used for the qualified medical expenses (see Qualified Medical Expenses, earlier) of:

- Yourself and your spouse;

- All your dependents; and

- Any person who would be your dependent except that:

- The person filed a joint return;

- The person had gross income of $4,700 or more; or

- You, or your spouse if filing jointly, are dependents of someone else."

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How many MSAs do you see?

I may have seen one in my life.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That’s one more than I’ve seen

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

something like......... as a participant of an MSA account the government has a unique provision that requires me to ask an awkward question........

and you ask everyone.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm not sure where that snippet is coming from. It suggests that spending on these items are subject to additional tax. But that hasn't been the case for years.

"The CARES Act also modifies the rules that apply to various tax-advantaged accounts (HSAs, Archer MSAs, Health FSAs, and HRAs) so that additional items are "qualified medical expenses" that may be reimbursed from those accounts. Specifically, the cost of menstrual care products is now reimbursable. These products are defined as tampons, pads, liners, cups, sponges or other similar products. In addition, over-the-counter products and medications are now reimbursable without a prescription. The new rules apply to amounts paid after Dec. 31, 2019. Taxpayers should save receipts of their purchases for their records and so that they are able to submit claims for reimbursements."

https://www.irs.gov/newsroom/irs-outlines-changes-to-health-care-spending-available-under-cares-act

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

California Form 3805P. There is an additional tax for California.

CA does not conform to the federal law that allows a rollover from an MSA to an Health Savings Account (HSA) to be treated as a tax-free distribution. If a California taxpayer rolls over his MSA into an HSA, this distribution is treated as an MSA distribution not used for qualified medical expenses and is subject to California income tax and the additional 12.5% tax under R&TC Section 17215.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I asked for the women to respond but I got responses from men. What does that mean?

I asked my wife how to broach this subject and she said I didn't need to and that I should "stay in my lane." Ouch!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Well then!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"but I got responses from men."

It's not supposed to matter. But for reference, we're all homo sapiens.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Speak for yourself. Some of us belong to the Canis latrans family

Slava Ukraini!