- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Do you precompute late penalties and interest?

Do you precompute late penalties and interest?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I like to have the software precompute the late penalties and interest. Do you do that?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I do. Then tell the client that IRS' figures may differ slightly.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Never have, never will. Who knows, the IRS might forget about them if you don’t remind them 😜

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I do, but I do not include them with the return. I put them in a paragraph on the client letter, noting that they are approximate.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Doesn't that require the clients letting you know when IRS will receive their payment? If they couldn't get it to IRS in time when required, why trust them to come up with a date now. Also, if "the check is in the mail," how long will it take IRS to receive it and cash it?

But yes, sometimes I do that, and include it on the return. But the software doesn't do the computation for the state, so I either have to eyeball that or tell the client to expect a notice.

Still drives me crazy to see other preparers including ES penalty with the return, when less than $100. Saw one the other day where it was $22. I think they charged $25 for the 2210.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

One benefit I have found is a reduction in notices sent to clients, a reduction in clients asking me about them, and a reduction in my time spent answering their questions.

Bob - I use an estimated pay date.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

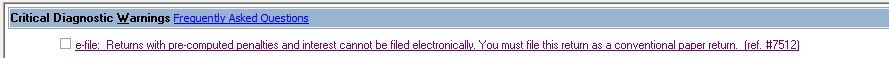

One drawback to including the precomputed penalties and interest is the inability to efile. Diagnostic 7512 is present when I ask LC to include the late-filing penalty (for Federal and California.)

Do you know the origin or purpose of this limitation?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Update the interest rates; put in the filing date (Screen 6) and let Lacerte do the math.

I do that, and I've never seen that diagnostic. Maybe it only shows up on delinquent returns with a date after 10.15 (17) deadline ?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I've seen it on some states - can't remember which ones. Not on federal.

For those states, I still present to the client the balance due with interest and penalty. I'll turn off the calc before efiling. Then go back in and turn it on.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

These returns are delinquent. I don't understand why that makes a difference.