- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- California Solar Credit 2016

California Solar Credit 2016

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What was the tax credit rate for residential solar in 2016?

was there a carryover limitation for subsequent years?

My client got a letter from FTB requesting proof of the solar expenditure, and questioning the carryover calculation.

Lacerte automatically limited the CA Solar credit to the amount of the CA tax for 2016, and then calculated the carryover to 2017,2018, & 2019.

I had not previously questioned how Lacerte was doing the calculation, and there does not seem to be any worksheet provided that outlines the application of the credit and carryover by year.

California is asking for that carryover calculation.

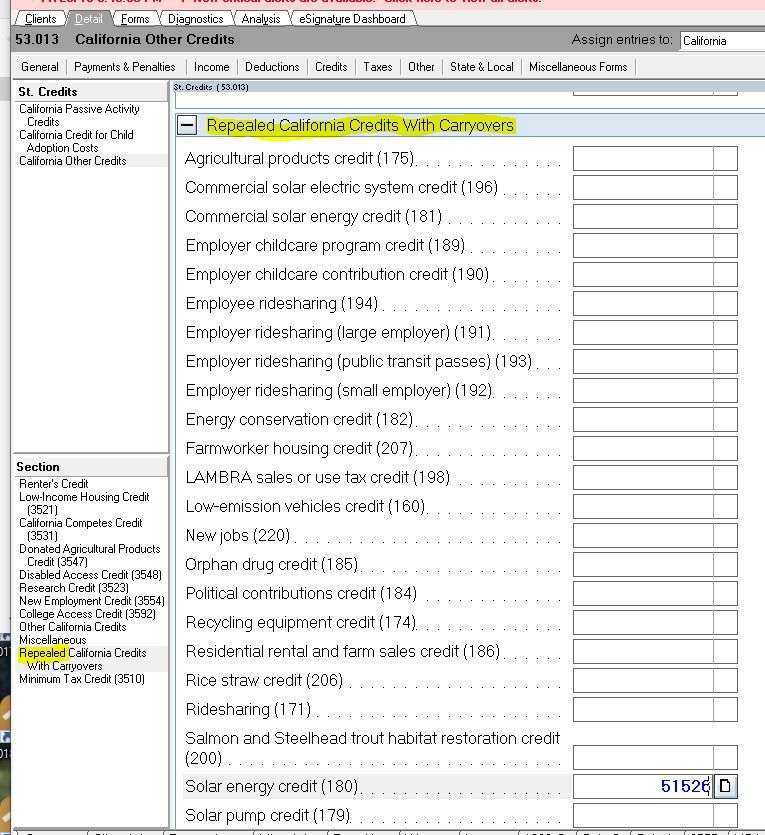

The Solar System Purchase in 2016 in the amount of $51,526

2016 original credit allowed on 540 (limited by CA Tax Due) was $7,056 (as filed)

2017 carryover credit allowed on 540 (limited by CA Tax Due) was $6,854 (as filed)

2018 carryover credit allowed on 540 (limited by CA Tax Due) was $4,170 (as filed)

2019 carryover credit allowed on 540 (limited by CA Tax Due) was $11,480

(2019 is not yet filed, but under review until I determine if these calculations were correct)

Is there anyone who can tell me if Lacerte is doing the calculations correctly?

I called and talked to several Lacerte specialists, who were unable to help me. I may get a call back as the last one disconnected unexpectedly.

Can anyone help with this?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You state "residential." Is this on a 540? If so what is the code number used for the credit? What FTB Form is attached to show the credit? What screen number did you enter the information in?

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Here is my guess for your input (NOTICE THE WORD REPEALED)

That is why there is no worksheet, you entered as a carryover of dinosaur (extinct) credits. Get your checkbook out, the client will want you to cover the penalty and interest.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for digging George! Thought I was losing it! LOL

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

the problem is I didn't enter the carryforwards, the credit started as a fully allowable CA 180 residential solar energy credit, and from that point on, the Lacerte proforma software carried it over to the subsequent years.

my questions are,

1. what was the original CA state tax credit rate?

2. what were the rules to carryforward?

3. did Lacerte do it correctly or did they mess up?

And if they are not correct, Frankly my mistake here has been to trust the Lacerte Software to do these calculations/ carryovers correctly. and I have not researched, or self checked every item on the pro-forma, trusting that they have used my 15K annual fee to make it correct.

But I can't find anywhere the information to calculate it so I can do the Math

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'll be honest, I dont remember CA ever having this credit. I did find this in the Instructions for Form FTB 3540

Credit Carryover Summary

Code 180 – Solar Energy Credit Carryover

You may claim a credit carryover for the costs of installing solar

energy systems under former R&TC Sections 17052.5 and 23601, only

if a carryover is available from tax years 1985 through 1988.

If its from back in 1985-1988, thats probably why I dont remember it.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can you tell me how this worked out? I have a similar situation.

Regards

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you. Did you ever get a reply from Lacerte?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello Basilio,

Was there a resolution to this mater? I have a similar situation using Proseries for same year.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪