- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- California 540 Requires County

California 540 Requires County

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The 2020 540 for California requires the entry of a County of residence. This is new and is not included on the Organizer. Any ideas of how you are going to proceed with this one?

Dennis McFerran

RTRP

San Jose CA (Santa Clara county)

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That's the government's advantage when they install e-filing: They can ask us data-entry clerks to input more and more information, and it costs them nothing. I'll have to take a look at the form. On a joint return, does it require two entries? What if someone moved from Riverside to Tulare on July 1? And of course, you can't use the current ZIP code because that may just be where they are currently quarantining.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Google has always worked for me when I have prepared other state returns that require a county to be selected on the return.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

A couple of options that I can think of:

(1) Ask the client.

(2) Google their city or address and "county".

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN You beat me by 9 seconds.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@TaxGuyBill - that's because I am farther north which means my answer started up higher which resulted in it gaining more speed so that it rolled faster than yours ------------------- 9 seconds faster to be exact 🤓

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

While that makes perfect sense, I would have thought that because it is colder up north, that would have slowed it down.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

All of my hot air negates the effects of the colder weather 😶

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That's the government's advantage when they install e-filing: They can ask us data-entry clerks to input more and more information, and it costs them nothing. I'll have to take a look at the form. On a joint return, does it require two entries? What if someone moved from Riverside to Tulare on July 1? And of course, you can't use the current ZIP code because that may just be where they are currently quarantining.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Im using ProSeries, not Lacerte, but dang you'd think they could give us a drop down menu to choose from or better yet, pull it from the zip code.

Wonder what California is going to use the County information for....

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

9 seconds is insignificant unless you're running a 100-yard dash

Dennis McFerran

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

AND according to what I saw by googling, some ZIP Codes span more than one county.

Dennis McFerran

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Totally agree. Since Lacerte is able to populate City and State if we enter the zipcode, you'd think it would be relatively easy to add county to that operation.

Dennis McFerran

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

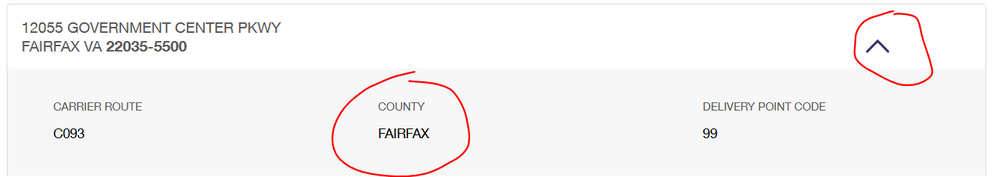

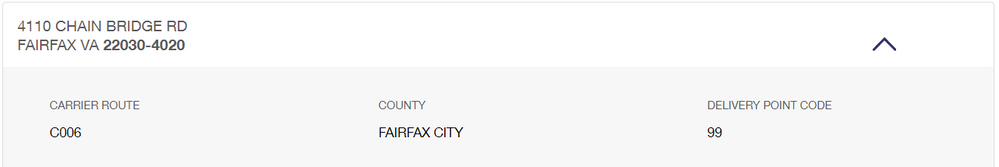

We've had to do this in VA for a long time. Someone with a "Fairfax" address or zip code might live in either Fairfax County or the City of Fairfax (each has their own locality code). In VA we also have personal property taxes at the locality level. So if they paid their car tax to the City of Fairfax instead of the County of Fairfax that's a pretty good clue.

For new clients (or clients who move) I used to use usps.com (now I don't have to, Drake populates this automatically based on the address). It's gotten harder to find on their website but you can look up a zip code by address:

https://tools.usps.com/zip-code-lookup.htm?byaddress

On the results page there's an arrow that gives you more details including the locality.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't know much about Drake. Do you have the ability to play around with Drake and determine if they have automatic populating for California counties? It's new here. Sounds like you've had that ability in VA to do this for some time.

Dennis McFerran

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

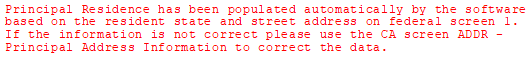

Do you have the ability to play around with Drake and determine if they have automatic populating for California counties?

Sure. The software populates the "County" field on the Federal basic taxpayer info screen for every address entered regardless of state. Some states use that info, some don't. This year it looks like CA does. I pulled up a CA client and see there's a new informational diagnostic on the CA return:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Virginia is weird like that. I know, I used to live there. At least back then, every county (sometimes city) had its own Commissioner of Revenue. One time the IRS Commissioner journeyed across the river to inspect an IRS walk-in office. He introduced himself to the Taxpayer Service staffer who said, "Oh, so you're a commissioner. We get lots of those here."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

To piggy back on this topic.

If your client is under the age of 18, ProSeries will not allow you to check the residency boxes either yes or no. Hence you are un able to e-file the return. I have been unsuccessful in try to contact support to inform them of this issue. The reason for the county residency verification is for election and voter registration. Being under the age of 18 (not able to vote) we are unable to file such a return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Has anyone asked FTB why they want it? My guess is that it has more to do with revenue sharing than voter registration. They still want it for adults with ITIN's, right? The problem may be that some people have a mailing address in one county (business location) but actually reside in another.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I havent had any issues with my clients under 18 being able to choose check these boxes. Do you have them as a CA resident down at the bottom of the fed info worksheet?

Ah, nevermind, Im using ProSeries, not Lacerte

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪