- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Calfornia EIC based on 1099-NEC

Calfornia EIC based on 1099-NEC

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

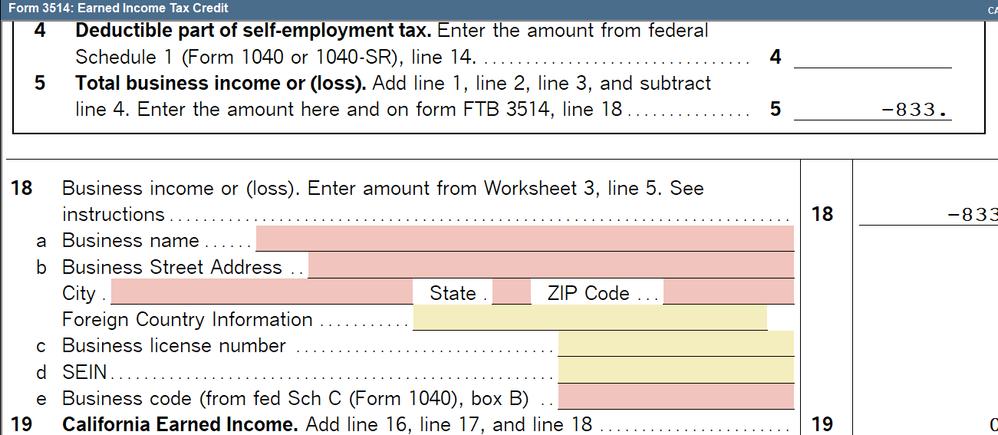

I have a taxpayer who qualifies for $3.00 of California EIC because of earnings on a form 1099-NEC. CA requires the taxpayer's "business information" including Business License Number, SEIN and form number where the income is claimed. None of this pertains to a person who is getting some misc. non-employee compensation. I'd like to supress the credit but I can't figure out how to do it. This is creating a fatal error and the diagnostic (#49687) says the return will be rejected if I don't provide this nonexistant information. Any suggestions?

Dennis McFerran

RTRP, San Jose, CA

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"who is getting some misc. non-employee compensation."

Some? That reporting makes it appear they got at least $600, and that is only the one reporting for them. Are you sure this is not a Schedule C filer?

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

He's a young 20 that just graduated and has income from Peace Corp on a 1099-NEC.

Dennis McFerran

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"CA requires the taxpayer's "business information" including Business License Number, SEIN and form number where the income is claimed."

ProSeries doesnt ask for all this, are you sure its required?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lacerte generates a critical diagnostic that says "Not addressing this diagnostic will result in the return being rejected".

Dennis McFerran

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Looks like PS automatically pulls the info from Sch C, the SEIN and Bus Lic dont appear to be required.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪