- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have 25 shareholders in an S Corp. Some purchased stock 10 years ago and don't know their bases. Many have outside basis. I do not prepare any of the individuals returns and have told the individuals that their tax preparer is responsible for determining their basis. How do I delete the S Corp basis schedules on the 1120S since they are very likely to be wrong.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Deleting is likely not a good choice.

Give each shareholder a copy of the 7203 and instructions that they will be REQUIRED to file with their tax return and have them give you a completed copy that you can then use to properly complete the basis schedule.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Deleting is 100% the right choice. Tracking basis is not the 1120S preparer's job. I provide it with the K-1 when I happen to know the right answer, but that's because I'm nice, not because I have to.

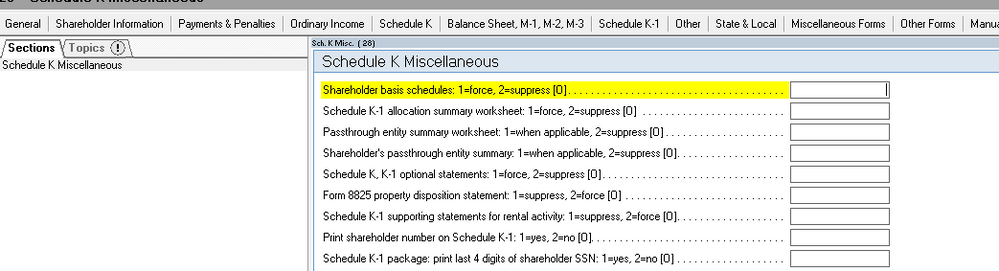

You want a screen called Schedule K Miscellaneous. The topmost item enter a 2 to suppress shareholder basis schedules. This is what it looks like in Lacerte: