- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

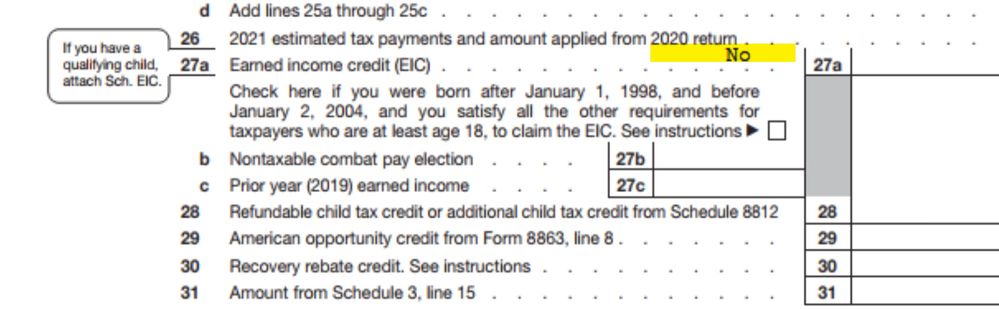

I have 3 clients under the age of 24, fulltime students who do not qualify for the EIC. They have each received notices from the IRS letting them know "they could be eligible". The letter suggests that next year they should put "NO" on the EIC credit line of the 1040. I cannot enter "NO" on the professional version. Is anyone else experiencing this problem? I dont want my clients to keep receiving letters that make them assume I made a mistake, when in fact its just a basic software issue not putting the word "NO" next to it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you do all the check boxes on the Federal Information Worksheet that would let the program know the client is not EIC eligible? Part IV - EIC information

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, including selecting the box to indicate they are a specified student for EIC purposes when filing without a qualifying child. Once I select that box, the software automatically stops calculating the EIC but apparently, we still need the words "NO" to show up on the 1040.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Wonder if someone at Intuit can explain when the program will enter the NO.

@Anonymous can you help with this question?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In ProSeries Professional, you won't be able to see it in the program. When printed, the program places a No automatically.

How can I suspend the EIC calculation?

The easiest way to suspend the calculation of EIC:

- Open the Federal Information Worksheet.

- Scroll down to Part IV- Earned Income Credit Information.

- Check the box Taxpayer notified by IRS that EIC cannot be claimed in 20YY.

From Common questions about Schedule EIC in ProSeries

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Gabi,

This doesn't help. Returns get sent electronically for the most part, not printed. Which means the IRS apparently is not getting "NO" on these electronically filed returns. This is an issue.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I also had 2 clients receive the same letter. It seems the IRS is trying to second guess the preparers. Generally speaking it happens when Junior does not qualify for any education credit so the IRS does not know they were a full time student for parts of 5 months. So we click they are specified student but somehow that does not get transmitted with e-file. So we are doing it Intuit's way but Intuit is not transmitting what we intended.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think the IRS Instructions are wrong/incomplete.

If you follow the Instructions, there is nothing that says that "No" should be entered, so ProSeries is doing it correctly. However, based the way the Instructions are set up, it seems to me that the IRS would want "No" in these circumstances. So in my opinion, the IRS probably wants "No" there but neglected to put it in the Instructions.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

IRS is never wrong. When they say "jump," we ask "how high?" Just try filing 1099-NEC income directly on Schedule SE without answering ten more questions on a Schedule C. If a college kid did that, I bet he would be expelled.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If the IRS directions do not specifically say to place "No" on the line, why is ProSeries placing it on the line for printed versions of the return but may not be doing it for efiled versions? It shouldn't be one but not the other. Either print "No" or don't print "No:. With that said, I guess we'll never truly know if "No" is included on efiled returns.