- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Discover

- :

- Events

- :

- Move Beyond Tax Season to Achieve year Round Revenue

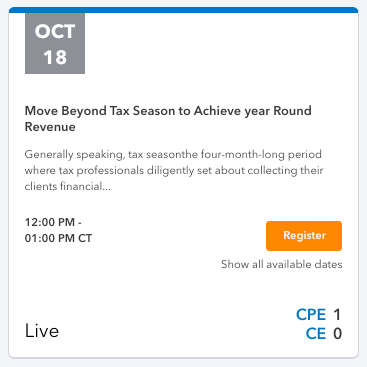

Move Beyond Tax Season to Achieve year Round Revenue

Move Beyond Tax Season to Achieve year Round Revenue

- Subscribe

- Mark as read

- Mark as new

Register for this webinar by following this link here.

Our speakers for this event are Josh Lance and Ryan Embree!

Josh Lance | Managing Director at Lance CPA Group | Head of Accounting at Practice Ignition

Ryan Embree | Partnerships | Practice Ignition

ABSTRACT:

Generally speaking, tax season—the four-month-long period where tax professionals diligently set about collecting their clients’ financial figures, making sense of everything, and submitting timely, accurate returns—is where accounting practices tend to make the majority of their yearly revenue.

What if there was a better way to run your firm?

As it happens, there is. Practices looking to avoid feast and famine type of scenarios should transition towards a year-round recurring revenue model, protecting their cash flow in the process.

Over the years, Josh Lance, CPA has expanded his firm’s business model to focusing more on recurring revenue and less on tax season. This expansion increased his revenue by 300%. Join Josh Lance, CPA of Lance CPA Group to discover new ways to serve your tax clients year round. During this webinar Josh will cover how to provide additional services, plan out your recurring revenue for the year and identify new revenue streams in your firm.

LEARNING OBJECTIVES:

By completing this webinar, you will be able to advise your clients on topics such as:

Identify new services to offer your tax clients

Tips on structuring your firm to be less reliant on tax season revenue

How to leverage sales and marketing efforts to obtain new revenue streams

Which one or all?

Pricing Strategies

Packaging and Bundling your services

Process and Workflow Efficiency

Managing a remote team

WHO SHOULD ATTEND?

Anyone who prepares tax returns and serves taxpayers or business clients.

Course Level: Basic

Course Length: 60 Minutes

Prerequisites: None

Delivery Method: Group-Live Internet

Field of Study: Business Management & Organization – Non-Technical

Recommended CPE: 1

Recommended CE: 0