Using Refund Advantage Pay-by-Refund with ProSeries

by Intuit•1• Updated 2 weeks ago

Before you start:

- Before you can begin e-filing returns containing a Pay-by-Refund bank product you must have completed your enrollment with Refund Advantage. See here for details on enrolling in Pay-by-Refund and verifying your enrollment status.

- Pay-by-Refund is only available on current year tax returns.

- For a return to be eligible for a Pay-by-Refund bank product it must meet the following criteria:

- The return must have a refund larger than the preparer fees and bank fees.

- The return must be filed electronically.

- The Pay-by-Refund application must be signed by the taxpayer before e-filing the return.

Table of contents:

When will the taxpayer receive their refund?

Pay-by-Refund is not a loan against the refund. The IRS or state tax agency needs to first release the funds to the bank before the taxpayer will receive their refund. The IRS issues most refunds within 21 days however it's possible the tax return may require additional review and could take longer.

What does Pay-by-Refund cost?

The fee for Pay-by-Refund is $59.90, this includes a technology fee of $19.95.

The technology fee includes the cost of programming specific Settlement Solution Provider software and communication protocols as well as mandated security testing. This fee will be taken out of the taxpayer's refund along with the bank fee. The fee is an industry-wide standard across all professional tax preparation software.

How do I request Pay-by-Refund for the taxpayer?

In order for your client to use Pay-by-Refund, the following steps must be completed before the return is electronically filed.

- Complete the client's tax return and clear any error messages.

- Ensure the return is marked for e-file.

- Enter any and all preparer fees on the Client Specific Billing Options worksheet.

- Open the Federal Information Worksheet.

- Scroll down to Part VIII - Direct Deposit and Refund Disbursement Options.

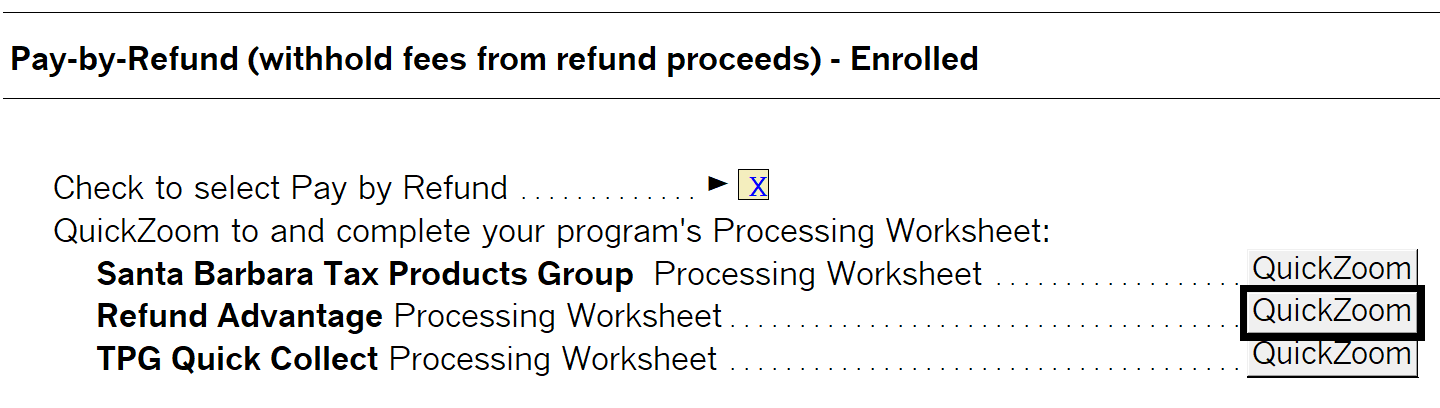

- In the Pay-by-Refund (withhold fees from refund proceeds) section check the Check to select Pay by Refund checkbox.

- Click on the QuickZoom button for the Refund Advantage Processing Worksheet.

- In State Pay-by-Refund Option section check Yes if you would like a state refund transfer to be added to the Pay-by-Refund.

- State Pay-by-Refund can only be e-filed if a federal return is being processed with Pay-by-Refund as well.

- Pick the Disbursement Method that your taxpayer is requesting.

- Complete all other required fields.

- Once the return is completed e-file the return.

- Upload any completed applications through the Refund Advantage account online.

To check the status of the Pay-by-Refund and print checks, you must sign in to your online Refund Advantage account and complete any additional steps in the Refund Advantage software.

The ProSeries client letter will not show information regarding the Refund Advantage bank product. A separate letter can be created outside of ProSeries to provide to your client about the bank product.

How do I request a cash advance for the taxpayer?

- Complete the client's tax return and clear any error messages.

- Ensure the return is marked for e-file.

- Enter any and all preparer fees on the Client Specific Billing Options worksheet.

- Open the Federal Information Worksheet.

- Scroll down to Part VIII - Direct Deposit and Refund Disbursement Options.

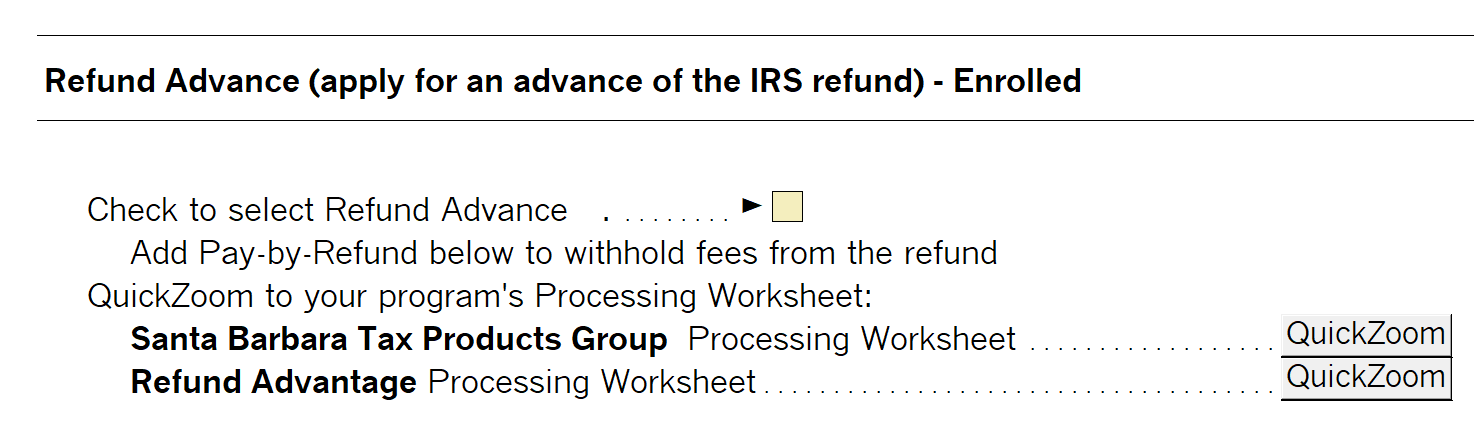

- In the Refund Advance (apply for an advance of the IRS refund) section check the Check to select Refund Advance checkbox.

- Click on the QuickZoom button for the Refund Advantage Information Worksheet.

- In State Pay-by-Refund Option section check Yes if you would like a state refund transfer to be added to the Pay-by-Refund.

- State Pay-by-Refund can only be e-filed if a federal return is being processed with Pay-by-Refund as well.

- Pick the Disbursement Method that your taxpayer is requesting.

- Complete all other required fields.

- Once the return is completed e-file the return.

- Upload any completed applications through the Refund Advantage account online.

How do I check the status of the Pay-by-Refund request?

- Open ProSeries.

- Go to the Pay-by-Refund HomeBase View.

- Highlight the client's return.

- From the E-File menu choose Pay-by-Refund, then Refund Advantage, then Update Selected Acknowledgments.

- Click OK.

- ProSeries will now download the most current status from the Intuit Electronic Filing Server.

How to review Reject Details for Pay-by-Refund:

To easily view rejection details for a bank application, we have provided details in the Pay-by-Refund HomeBase View.

To view reject details:

- Change your HomeBase View to Pay-by-Refund.

- Find the Next Steps column.

- The record will show a View Reject Details hyperlink, click the link.

- The Pay-by-Refund Reject Details screen will explain what needs to be done before resubmitting the bank application.

- Once corrections have been made, the bank application for this return can be resubmitted. Go to E-File ⮕ Resubmit Bank Application...

How do I print the taxpayers check?

To print checks:

- Open ProSeries.

- From the E-file menu choose Pay-by-Refund then Refund Advantage and Website.

- Login to Refund Advantages web portal.

- Follow the online instructions to print checks.

My firm is part of a service bureau, how do I edit those fees?

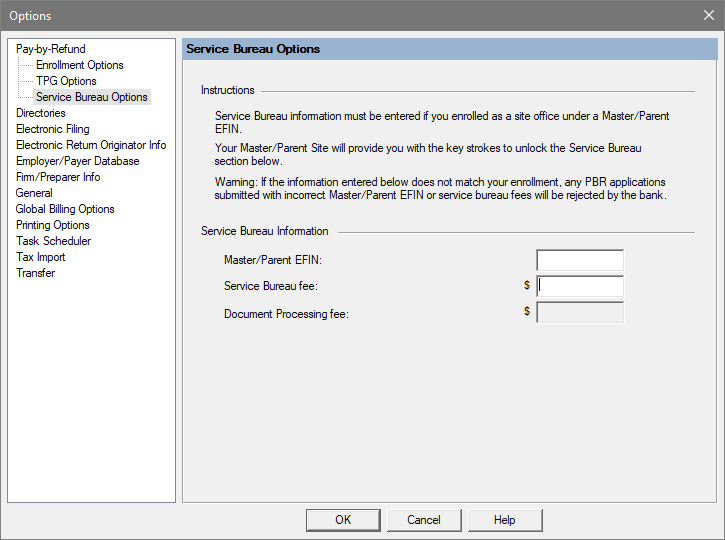

If your firm is not part of a service bureau this section would not apply to your company. Only if you are part of a service bureau should you proceed:

- From the Tools menu select Options.

- On the left side of the screen choose Service Bureau Options.

- While on the Service Bureau Options screen press and hold down the CTRL key, press and hold down the Shift key and press and release the S key. This three-part keystroke will enable to Service Bureau Information fields.

How do I correct and resubmit a failed Pay-by-Refund request?

- Open the client file.

- Make any changes needed to correct the rejection.

- From the E-File menu choose Re-transmit Bank Application.

- Click Yes on the Do you want to save the question.

- Once the application has been successfully retransmitted click OK.