How to enroll in Pay-by-Refund

by Intuit•16• Updated 5 days ago

Before you start:

- For an overview of the different Pay-by-Refund programs available, see here.

- You can only enroll in one Pay-by-Refund program at a time.

- You must have an order placed for your tax year 2025 program or be enrolled in Auto-Renew before you can proceed.

- Enrollment will be available for both Santa Barbara Tax Products Group and Refund Advantage around late September.

- EFIN verification is required before you can enroll in Pay-by-Refund. If you have not yet verified your EFIN with Intuit, see here.

Click on your tax program below to learn how to enroll in Pay-by-Refund and check your enrollment status.

Table of contents:

Steps for ProSeries Professional and ProSeries Basic preparers:

How do I enroll online to offer Pay-by-Refund?

Complete the enrollment application form online through your My Account and the bank will follow up to complete the process.

To access My Account to start your enrollment process:

- Sign in to MyAccount.

- Enter your Email or user ID and select Sign In.

- Enter your password or MFA code to complete signing in.

- On the left side of the screen, select Add-ons ⮕ Pay-by-Refund.

- Click on the Select button for the bank product processor of your choice.

- Note: Ensure that the correct product is selected at the top of the My Account Pay-By-Refund menu.

- Complete the Pay-by-Refund enrollment application.

- Click Apply to submit your application.

Notes:

- P.O. boxes aren't considered a valid address for enrollment.

- Be mindful that some fields require specific formatting, such as dates and other numeric fields.

- When asked for a phone number, you will want to provide your ERO phone number -- not your office's phone number, should it vary.

How do I enroll in ProSeries to offer Pay-by-Refund?

Note: If you want to enroll before next year's program is available, you must follow the steps above for online enrollment. This method can only be used once next year's ProSeries has been released and installed on your computer.

After installing ProSeries, you will see a change in the ProSeries practice setup that allows you to Enroll Now.

To start your enrollment process:

- Open ProSeries.

- On the ProSeries Practice Setup screen, click Next until you see Enroll in Pay by Refund.

- Click on Enroll Now to open your web browser to the online enrollment.

- Click on the Select button for the bank product processor of your choice.

- Note: Ensure that the correct product is selected at the top of the My Account Pay-By-Refund menu.

- Note: Ensure that the correct product is selected at the top of the My Account Pay-By-Refund menu.

- Complete the Pay-by-Refund enrollment application.

- Click Apply to submit your application.

Notes:

- You will no longer be able to print checks through the ProSeries software, all checks will available through the banks online web portals.

- ProSeries is approved to have our PBR banks offer cash advances through both SBTPG and Refund Advantage.

- P.O. boxes aren't considered a valid address for enrollment.

- Be mindful that some fields require specific formatting, such as dates and other numeric fields.

- When asked for a phone number, you will want to provide your ERO phone number -- not your office's phone number, should it vary.

How do I check the status of my enrollment online and modify my enrollment?

To access My Account to view your enrollment status:

- Go to MyAccount.

- Sign in with your Email or user ID and Password.

- From the left of the screen, select Add-ons ⮕ Pay-by-Refund.

- Review the status of your bank of choice.

- Select the Manage button to make changes to your enrollment.

Enrollment statuses

- Draft Saved - Your application has been not yet been submitted. Click on Manage and submit your application.

- Pending - The bank is still processing your enrollment application.

- Approved - Your application has been approved and you are ready to start processing Pay-by-Refund returns.

- Action Required - The bank has not approved the application and the bank needs further information. Contact the bank for more information.

- Denied - Your application has been denied and you will need to select a different bank product provider. Contact the bank for further information.

How do I check the status of my enrollment in ProSeries?

To view your enrollment status in ProSeries:

- From the Tools menu, select Options.

- Under Pay-by-Refund, select Enrollment Options.

- Review the Enrollment Information section.

- Select the bank in the Selected Bank drop-down menu.

- Click Refresh to refresh the enrollment status.

- Review the status of your bank of choice.

Enrollment statuses

- Draft Saved - Your application has been not yet been submitted. Click on Manage and submit your application.

- Pending - The bank is still processing your enrollment application.

- Approved - Your application has been approved and you are ready to start processing Pay-by-Refund returns.

- Action Required - The bank has not approved the application and the bank needs further information. Contact the bank for more information.

- Denied - Your application has been denied and you will need to select a different bank product provider. Contact the bank for further information.

How do I enroll in a cash advance program?

In order to participate in a cash advance program you will need to select this option during enrollment, or contact the bank to sign up later.

- Funding takes place after the IRS has accepted the tax return. This is known as a Post-Ack offering.

- Cash advances are only available from e-file launch in January until mid-March.

- When the taxpayer opts to receive their cash advance funding via the prepaid card the remainder of the refund will be deposited to the same card.

| Santa Barbara Tax Products Group | Refund Advantage | |

| How to enroll? | Once you've enrolled to offer pay by refund you can opt in for Cash Advanced on the SBTPG Web Portal. | When you enroll to offer pay by refund you'll be able to opt in for Cash Advances during the enrollment. |

| What does it cost? | These loans are free to the taxpayer and cost the preparer $39.95. This fee can be waived through a $39.95 rebate at the end of tax season when the loan is disbursed and IRS-funded on a prepaid Green Dot card. | These loans are free to the taxpayer and cost the preparer $39.95. This fee can be waived through a $39.95 rebate at the end of tax season when the loan is disbursed and IRS-funded on a FasterMoney Visa Prepaid Card. |

| What is the loan amount? | Up to $2000 per taxpayer | Up to $1000 per taxpayer |

| Where can I learn more? | Click here | Click here. When reviewing the reference material the No-Cost Taxpayer Refund Advance Loans are the ones available in ProSeries. |

Steps for Lacerte preparers:

How do I enroll online to offer Pay-by-Refund?

Complete the enrollment application form online through My Account and the bank will follow up to complete the process.

To access My Account to start your enrollment process:

- Sign in to MyAccount.

- Enter your Email or user ID and Password and click Sign In.

- On the left side of the screen, select Add-ons ⮕ Pay-by-Refund.

- Click on the Select button for the bank product processor of your choice.

- Note: Ensure that the correct product is selected at the top of the My Account Pay-By-Refund menu.

- Complete the Pay-by-Refund enrollment application.

- Click Apply to submit your application.

Notes:

- P.O. boxes aren't considered a valid address for enrollment.

- Be mindful that some fields require specific formatting, such as dates and other numeric fields.

- When asked for a phone number, you will want to provide your ERO phone number -- not your office's phone number, should it vary.

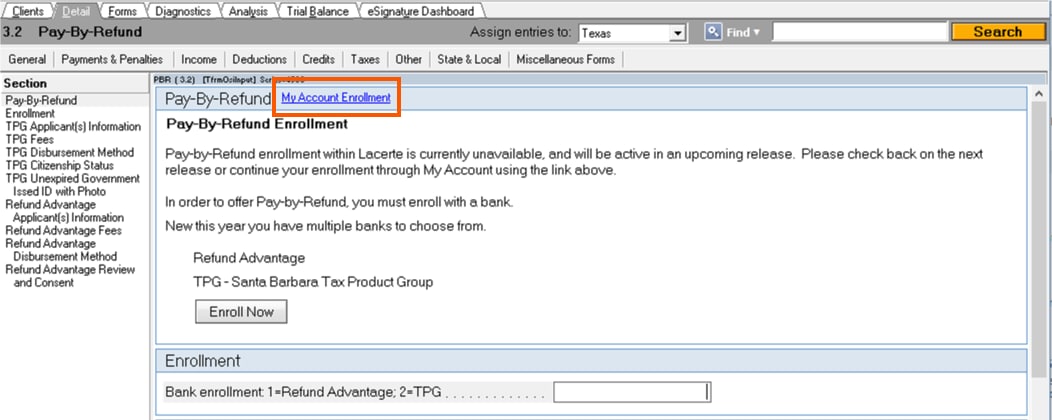

How do I enroll in Lacerte to offer Pay-by-Refund?

You can find a link to Pay-by-Refund enrollment inside any individual return.

To start your enrollment process:

- Open Lacerte to the Individual module.

- Select a client from your Clients List.

- Go to Screen 3.2, Pay-by-Refund.

- Click on My Account Enrollment to open your web browser to the online enrollment.

- Click on the Select button for the bank product processor of your choice.

- Complete the Pay-by-Refund enrollment application.

- Click Apply to submit your application.

Notes:

- P.O. boxes aren't considered a valid address for enrollment.

- Be mindful that some fields require specific formatting, such as dates and other numeric fields.

- When asked for a phone number, you will want to provide your ERO phone number -- not your office's phone number, should it vary.

How do I check the status of my enrollment online?

To access My Account to view your enrollment status:

- Go to MyAccount.

- Sign in with your Email or user ID and Password.

- From the left of the screen, select Add-ons ⮕ Pay-by-Refund.

- Review the status of your bank of choice.

Enrollment statuses

- Draft Saved - Your application has been not yet been submitted. Click on Manage and submit your application.

- Pending - The bank is still processing your enrollment application.

- Approved - Your application has been approved and you are ready to start processing Pay-by-Refund returns.

- Action Required - The bank has not approved the application and the bank needs further information. Contact the bank for more information.

- Denied - Your application has been denied and you will need to select a different bank product provider. Contact the bank for further information.

Steps for ProConnect Tax preparers:

How do I enroll to offer Pay-by-Refund?

Complete the enrollment application form through your program, and the bank will follow up to complete the process.

Follow these steps to enroll:

- Sign in to your ProConnect account.

- Select

top right of your screen.

top right of your screen. - Select Pay-by-Refund enrollment.

- Click on the Select button for the bank product processor of your choice.

- Note: Ensure that the correct product is selected at the top of the My Account Pay-By-Refund menu.

- Complete the Pay-by-Refund enrollment application.

- Click Apply to submit your application.

Notes:

- P.O. boxes aren't considered a valid address for enrollment.

- Be mindful that some fields require specific formatting, such as dates and other numeric fields.

- When asked for a phone number, you will want to provide your ERO phone number -- not your office's phone number, should it vary.

How do I check on the status of my enrollment?

You can verify your enrollment status in ProConnect Tax.

Follow these steps to check your enrollment status:

- Sign in to your ProConnect account.

- Select

at the top right of your screen.

at the top right of your screen. - Select Pay-by-Refund enrollment.

- Review the status of your bank of choice.

Enrollment statuses

- Draft Saved - Your application has been not yet been submitted. Click on Manage and submit your application.

- Pending - The bank is still processing your enrollment application.

- Approved - Your application has been approved and you are ready to start processing Pay-by-Refund returns.

- Action Required - The bank has not approved the application and the bank needs further information. Contact the bank for more information.

- Denied - Your application has been denied and you will need to select a different bank product provider. Contact the bank for further information.

What do I do if I get an error saying "EFIN has debt with SBTPG"?

If you receive this error message, it'll prevent your enrollment application from being sent to the bank. Contact SBTPG for more information.

Contacting the bank for more information:

SBTPG and QuickCollect: 800-779-7228 for existing customers or 877-901-5646 for new customers.

Refund Advantage: 800-967-4934