CA SUTA ETT or DI is incorrect or not calculating in EasyACCT

by Intuit• Updated 11 months ago

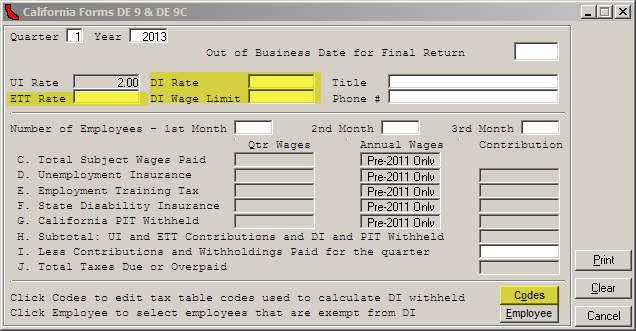

CA SUTA report has no ETT, DI calculating, or it is calculating with last year's rates and limits.

- The SDI or Disability Insurance rate and wage limit is directly input on the CA SUTA input screen, along with the ETT or CA Employers Training Tax %.

- Enter the new DI rate and wage limit in this screen for each company the first time accessed in each tax year.

- Open the "Codes" button at the bottom of the input screen and check for the Local Codes Used = SDI and the Other State Tax Codes Used = C1.

- Verify that each employee has all the codes completed properly on their Wage/Withholding screen. SUTA = CA, ST = CAM or CAS, local = SDI, Other = C1.

If there were any changes in step 4, it may be necessary to recalculate checks and reprint payroll journals for each month.