Entering the Shareholders Schedule K-1 in the individual return in ProSeries

by Intuit•13• Updated 2 weeks ago

This article will help you with the most frequently asked questions on the Shareholder's Share of Income, Credits, Deductions, etc worksheet.

For more Schedule K-1 resources, check out our Tax topics page for Schedule K-1 where you'll find answers to the most commonly asked questions.

To open the Schedule K-1 Worksheet:

- Open the Individual return.

- Press F6 to bring up Open Forms.

- Type S to highlight the K-1 S Corp.

- Click OK.

- Select the existing K-1 and click Select or enter the partnership name and click Create.

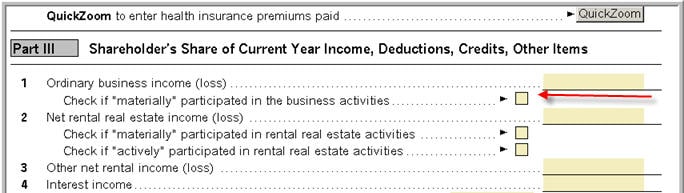

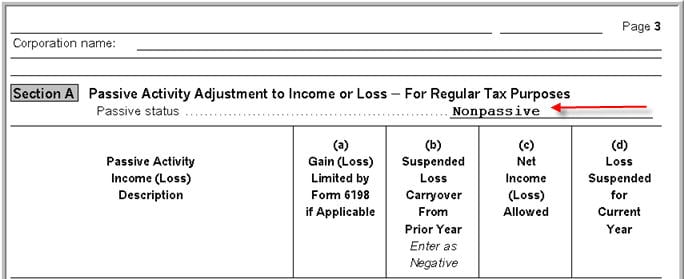

- Complete Part I-III from the Schedule K-1 received.

What's new for Schedule K-1 for tax year 2023:

For tax year 2023 the IRS has added multiple new codes to the Schedule K-1. Most changes involve new codes for Other Income, Other Deductions, Other Credits and Other Information to provide additional details for when the 1040 is completed. To see the Partnership codes, see here, to see the S-Corporation codes see here and scroll down to the code lists on the last pages of the instructions.

Related topics:

More like this

- Common questions about New York shareholder's modifications in Lacerteby Intuit

- How to enter and calculate the qualified business income deduction, section 199A, in ProSeries on Form 8895by Intuit

- Common questions about New York shareholder's modifications in ProConnect Taxby Intuit

- Entering the Partners Schedule K-1 in the individual return in ProSeriesby Intuit