Using weighted averages for Schedule K-1 Form 1065 in ProSeries

by Intuit•7• Updated 1 year ago

ProSeriesprovides you the ability to setup Weighted Averages for your Partners. This is very useful when a Partner joins, or leaves the Partnership during the year and can be used instead of the normal profit/loss/ownership percentages for the Schedule K-1.

For more Schedule K-1 resources, check out our Tax topics page for Schedule K-1 where you'll find answers to the most commonly asked questions.

To setup and use Weighted Averages:

- Open the partnership client file.

- Press F6 to open the Open Forms window.

- Type in Addl and then press Enter to open the Additional Special Allocation and Weighted Average Worksheet.

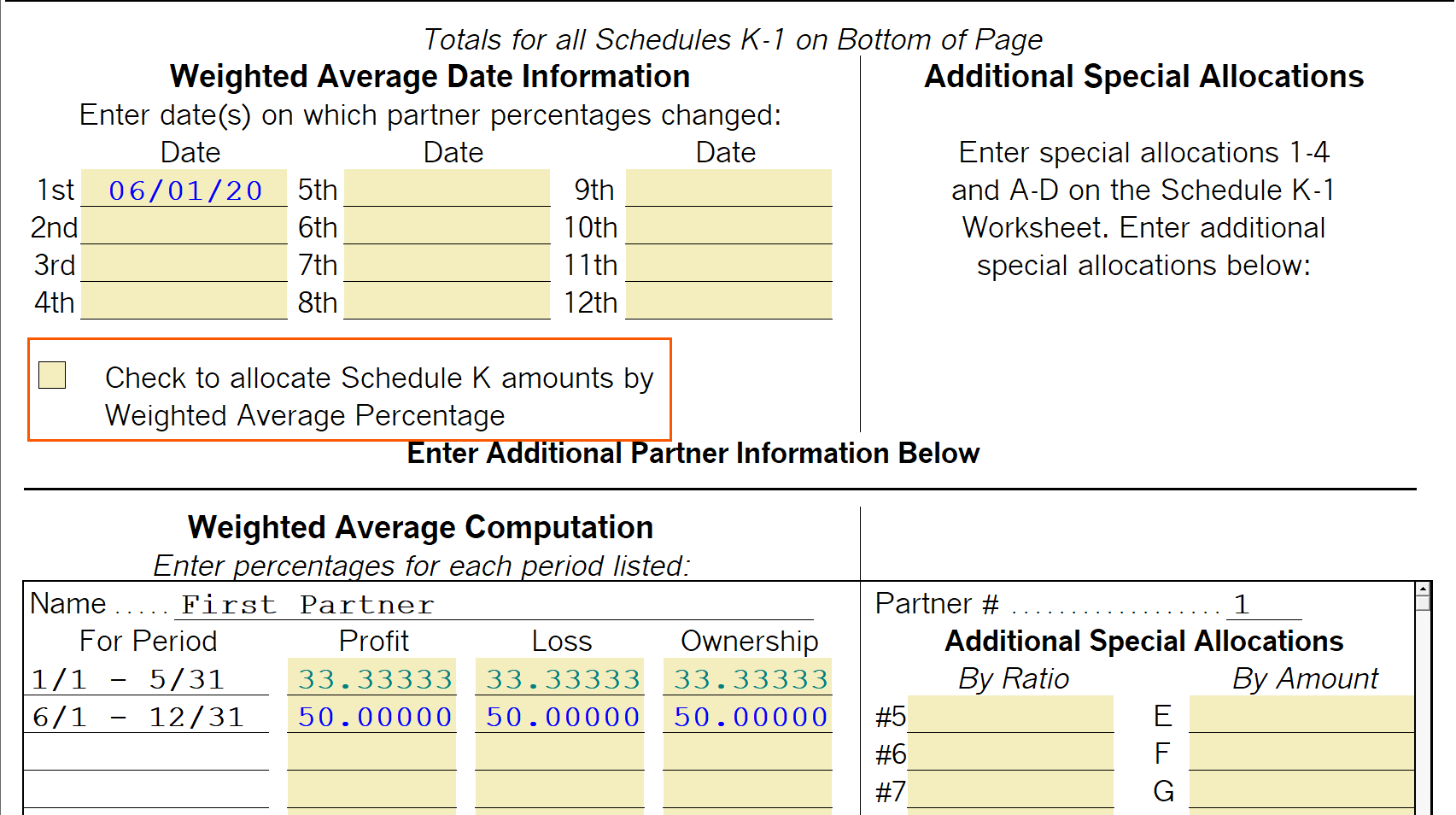

- In the Weighted Average Date Information section, enter in chronological order the dates that percentages changed during the year.

- Only 12 different dates can be entered for any given year.

- Scroll down to the Weighted Average Computation section to see the first partner.

- Adjust the first partners percentages for each date range.

- Press Page Down on the keyboard to show the next partner.

- Adjust the second partners percentages for each date range.

- Repeat until all partners percentages have been updated.

Using the weighted average calculation

ProSerieswill show the Weighted Average for each partner, but they will not be automatically used for calculations. To use the calculated percentage, you must check the box "Check to allocate Schedule K amounts by Weighted Average Percentage".