How to enter special allocations to partners on Form 1065 in ProSeries

by Intuit•12• Updated 2 months ago

ProSeries allows you to enter special allocations of any item of Schedule K income, gain, loss, deduction, or credit. Schedule K items may be specially allocated to partners by amount or by ratio. Decide whether to allocate by amount or ratio and follow the instructions in this article.

For more Schedule K-1 resources, check out our Tax topics page for Schedule K-1 where you'll find answers to the most commonly asked questions.

This article will help you:

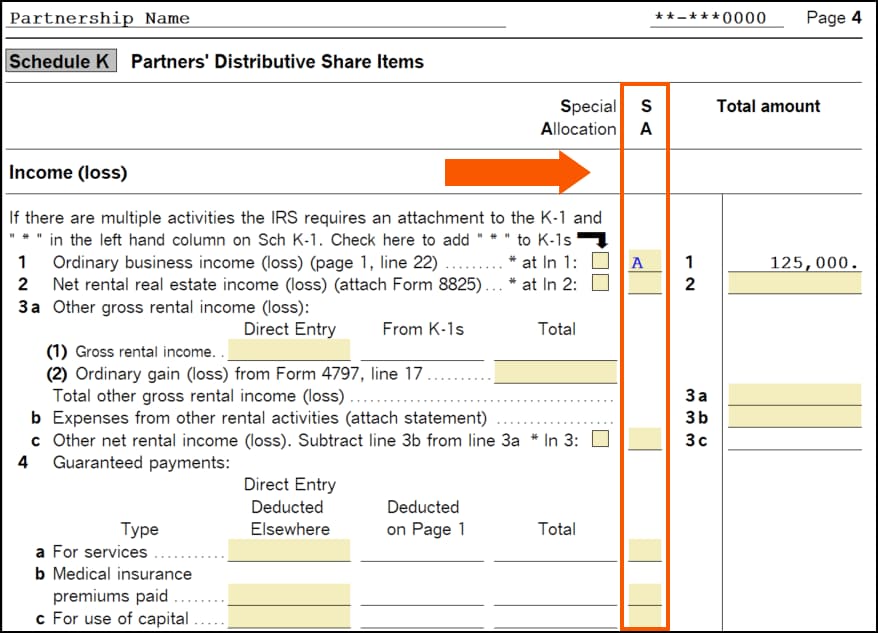

- Understand how to enter special allocations to partners on Form 1065, Page 4, Schedule K.

- It's also possible to enter special allocations on Form 1065, Page 5, Schedule M-1 and Schedule M-2, and on the Schedule M-1 Items Worksheet. The process outlined in this article is the same for each.

Table of contents:

| ‣ Special allocations by amount |

| ‣ Special allocations by ratio |

| ‣ Common questions about special allocations |

Special allocations by amount

Special allocation by amount allows you to allocate a partnership item of income, gain, loss, deduction, credit, etc. to certain (or all) partners by specific dollar amounts.

A total of four special allocation by amount fields are provided on the Schedule K-1 Worksheet. If more than four special allocation fields are needed, there are more fields available on the Additional Special Allocations and Weighted Average Worksheet.

Follow these steps to make special allocations by amount on Schedule K-1:

- Go to Form 1065 p4-5.

- Enter an A, B, C, or D in the SA field next to the item you want to allocate.

- Click the magnifying glass to QuickZoom to the corresponding field on the Schedule K-1 worksheet.

- Enter the appropriate amount for each partner.

- For additional allocations by amount (E through N and Q, R, S), open the Additional Special Allocations and Weighted Average Worksheet:

- Press F6 to open the forms menu.

- Type Addl and press enter.

Special allocations by ratio

Special allocation by ratio allows you to allocate a partnership item of income, gain, loss, deduction, credit, etc. to partners according to ratios (percentages) that you specify.

A total of four special allocation by ratio fields are provided on the Schedule K-1 Worksheet. If more than four special allocation fields are needed, there are more fields available on the Additional Special Allocations and Weighted Average Worksheet.

Follow these steps to make special allocations by ratio on Schedule K-1:

- Go to Form 1065 p4-5.

- Enter a 1, 2, 3, or 4 in the SA field next to the item you want to allocate.

- Click the magnifying glass to QuickZoom to the corresponding field on the Schedule K-1 Worksheet.

- Enter the appropriate percentage for each partner.

- For additional allocations by percentage (5 through 9), open the Additional Special Allocations and Weighted Average Worksheet:

- Press F6 to open the forms menu.

- Type Addl and press enter.

Common questions about special allocations

What special allocation codes are valid for each method?

Entering a valid code in the SA column determines the special allocation method used: ratio, amount, or residual allocation. In order to calculate correctly you must enter a valid special allocation code.

Valid "by ratio" codes:

P, L, or O

Specially allocates by end of year profit (P), loss (L), or ownership (O) percent as entered on each partner's Schedule K-1 Worksheet.

WP, WL, or WO

Allocates by the weighted average profit, weighted average loss, or weighted average ownership percent from the Additional Special Allocations and Weighted Average Worksheet. Check the box on the Additional Special Allocations and Weighted Average Worksheet to allocate Schedule K amounts by the weighted average percentages.

1, 2, 3, or 4

Allocates by the percentage entered next to #1, #2, #,3, or #4 on each partners' Schedule K-1 Worksheet, under Special Allocations By Ratio.

5, 6, 7, 8, or 9

Allocates by the percentage entered next to #5, #6, #7, #8, or #9 on each partners' By Ratio column on the Additional Special Allocations and Weighted Average Worksheet.

Valid "by amount" codes:

A through S (excluding P, L, and O)

Allocates by the amount entered next to A, B, C, or D on each partners' Schedule K-1 Worksheet, Special Allocations section. E-K, M, N, and Q-S allocates by the amounts entered in the By Amount column on the Additional Special Allocations and Weighted Average Worksheet.

Valid residual allocation codes

Any valid amount code immediately followed by a valid ratio code forms a valid residual allocation code.

- A ratio code followed by an amount code is not valid.

- Adding + after a residual allocation code will allocate the residual to all partners, including those receiving a specially allocated amount.

Here are some examples of sample residual allocation codes and how they work:

- Code AP: Allocate the exact dollar amounts specified in the By Amount field A. Allocate the residual to all remaining partners based on their end of year profit percentage.

- Code J3: Allocate the exact dollar amounts specified in the By Amount field J on the Additional Special Allocations and Weighted Average Worksheet. Allocate the residual to all remaining partners based on the percentage entered on By Ratio field #3 in the Special Allocations section of their Schedule K-1 Worksheet.

Examples: Specially allocating interest income by amount or ratio

Follow these steps to specially allocate interest income by amount:

- Go to Form 1065 p4-5, line 5, Interest income.

- Enter the total interest income for all partners.

- In the SA field to the right of this line, enter a valid SA by amount code.

- Click on the magnifying glass or press CTRL + Q on your keyboard to QuickZoom to the Schedule K-1 Worksheet.

- Go to the field labeled By Amount that corresponds to the SA code you entered in step 3.

- For each applicable partner, enter the amount that partner should get.

- After you have entered an amount for each partner who should get interest income, scroll down the Schedule K-1 Worksheet to view the Totals for all Schedules K-1. Be sure that the total amount for all partners equals the amount of interest income the partnership received.

- Go to the Sch K Reconciliation. Review each item that's been allocated to make sure each partner has the correct dollar amount.

Follow these steps to specially allocate interest income by ratio:

- Go to Form 1065 p4-5, line 5, Interest income.

- Enter the total interest income for all partners.

- In the SA field to the right of this line, enter a valid SA by ratio code.

- Click on the magnifying glass or press CTRL + Q on your keyboard to QuickZoom to the Schedule K-1 Worksheet.

- Go to the field labeled By Ratio that corresponds to the SA code you entered in step 3.

- For each applicable partner, enter the special allocation ratio that the partner should get.

- After you have entered a ratio for each partner who should get interest income, scroll down the Schedule K-1 Worksheet to view the Totals for all Schedules K-1. Be sure that the By Ratio total equals 100%.

- Go to the Sch K Reconciliation. Review each item that's been allocated to make sure each partner has been allocated the amount you intend.

How do I make a special allocation that only affects the current-year increase (decrease) of the partners' capital account on the partners' Schedule K-1, line L?

- Open the client return.

- Open the Partnership Informantion Worksheet.

- Scroll down to Part IV - Schedule K-1 Information.

- Locate the K-1 Analysis of Partner's Capital Account Options (Schedule K-1, Item L, Row C) section.

- Mark the checkbox labeled Multiply total partnership amounts by each partners K-1 allocation percentage.

- Go to the Schedule K-1 Worksheet.

- Set up your special allocations for the partners.

- The allocation should match the amount from Schedule M-3, line 3.

- Go to Form 1065, p4-5.

- Scroll down to Schedule M-2.

- Enter your special allocation code to the left of line 3.

- Review the Schedule K-1 for accuracy.

If you mark the checkbox labeled Sum the individual line items on each partner's Schedule K-1 on the Partnership Information Worksheet, you won't be able to do a special allocation that affects only the partners' capital accounts.

How do I allocate section 754 depreciation to a partner?

To allocate section 754 depreciation to a specific partner, follow these steps:

- Open the Asset Entry Worksheet.

- You may do this by pressing F6 on your keyboard, typing DEE, and pressing Enter.

- Mark the checkbox labeled Check if IRC Section 754 adjustment.

- Open the Schedule K-1 Worksheet.

- Locate the Special Allocations subsection.

- For the partner receiving the allocated amount, enter the percent (if by ratio) or dollar amount (if by amount).

- Open Form 1065, p4-5.

- Locate Line 13d, C - Section 754 depreciation.

- Enter the special allocation code used in step 5 in the SA column.

For example, if you entered an amount in line A of the By Amount column for step 5, your special allocation code is A for this step.

Make sure the allocated amount shows on the Schedule K-1, line 13 for the partner receiving the allocation.

Learn more about special allocations using Tax Help in ProSeries

For more information and examples on using special allocations, please see the Tax Help for special allocations in your program.

To open Tax Help, just click inside any field in the SA column. Then, press F1 on your keyboard.