Allocating recourse debt as nonrecourse or specially allocating recourse debt in a 1065 with LLC members in ProSeries

by Intuit•6• Updated 1 week ago

When working on a Form 1065 with LLC members and you receive the following error message:

- "Form 1065 p4-5: Recourse liabilities. The program will not allocate recourse debt to Limited Liability Company Members. Either reclassify the debt as nonrecourse or enter a special allocation code to indicate how the amount should be allocated."

There are two ways to resolve this error:

- Reclassify the debt as nonrecourse, or

- Enter a special allocation code to allocate the recourse debt.

Please refer to the IRS instructions for Form 1065 and the Schedule K-1 for determining if you need to keep this amount as recourse or if you need to classify it as nonrecourse.

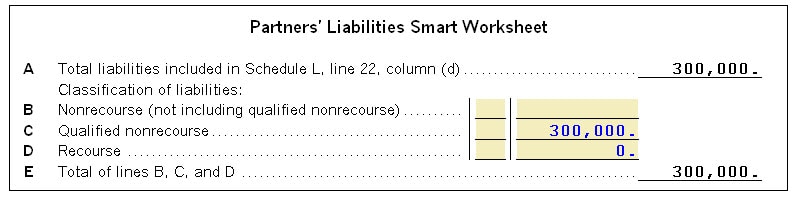

Option 1 - Reclassifying the debt as nonrecourse:

- Open the Form 1065, page 5.

- Find the Partners' Liabilities Smart Worksheet located below the Schedule L.

- Input the amount of the debt reported on line D to the amount on line C.

- Remove the number on line D and key in a 0.

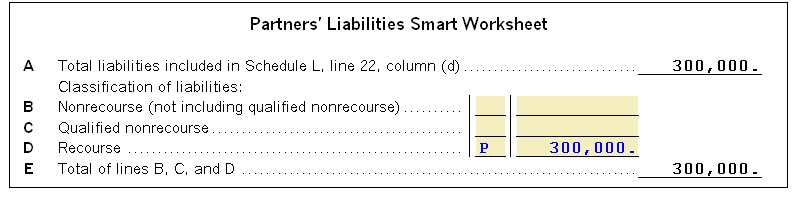

Option 2 - Enter a special allocation code to allocate the recourse debt:

- Open the Form 1065, page 5.

- Find the Partners' Liability Smart Worksheet located below the Schedule L.

- Enter a special allocation code in the column to the left of the dollar amount on line D.

- To allocate by the partners profit percentage enter P.

- To allocate by the partners loss percentage enter L.

- To allocate by the partners ownership percentage enter O.

- To allocate by any other dollar figure please see 1065, Special Allocation to Partners.

More like this

- Common questions about Partnership Recourse and Nonrecourse loans in Lacerteby Intuit

- Understanding the Deductible Home Mortgage Interest Worksheet in ProSeriesby Intuit

- Understanding Schedule K-1 self-employment income for partners and LLC members in ProConnect Taxby Intuit

- Entering Recourse and Nonrecourse loans in the Partnership return in ProConnect Taxby Intuit