Resolving proforma errors in Lacerte

by Intuit•1• Updated 2 months ago

Before you start:

- This article references default installation paths and uses YY to reference the tax year in 20YY format. C: will always indicate the local drive and X: will always indicate the network drive.

Table of contents:

How to fix common problems and errors with proforma

There are few possible reasons why this error message may present itself, and we'll be going over each below.

Step 1: Make sure the current year tax program and the prior year tax program are both updated

- Open Lacerte 2024.

- From the Tools menu, select Lacerte Updates.

- Open Lacerte 2025.

- From the Tools menu, select Lacerte Updates.

- Attempt to Transfer Clients (Proforma) the client. If it fails, continue to the next step.

Step 2: Make a copy of the prior year tax return

- Click on the Clients tab to view the list of your clients.

- Highlight the client that needs to be copied.

- Click on the client and select Copy (or hold down Ctrl+C).

- Enter the client number for the copy in the Copy Client window.

- Click OK.

- Attempt to Transfer Clients (Proforma) the client once more. If it fails, continue to the next step.

Step 3: Check input screens in return for any NON-ASCII characters

- Open the prior year return that the client was Proforma'd from.

- Within the Detail tab, use the CTRL+W keys to enter Batch Mode.

- Review input screen that show in bold.

- Search the Description field for any erroneous characters:

- Look for a line "|", extra text, or empty spaces.

- Clicking the input field will show the correct text.

- Look for any non-ASCII (American Standard Code for Information Interchange) characters. Examples: Ä Ë Ï Ö Ü Ÿ Ḧ Ẅ Ẍ ẗ ẞ ß Æ æ § ® © . These tend to appear more commonly in the Foreign Address input fields.

- Delete any erroneous characters and re-enter the correct data.

- To exit Batch Mode, click on the Detail menu once more and choose Switch to Interactive.

- Attempt the Proforma once more.

Step 4: Rename the Custom Client Letter file for the client

In a small number of returns, sometimes the custom client letter can get corrupted and prevent proforma from happening. If we rename it, the program will create a new one the next time the client is accessed.

- Make note of the client number on the file you want to proforma.

- In the prior year program, go to Help and select Troubleshoot (or press F10).

- Make note of the data path that is listed.

- In Windows File Explorer, browse to that data path.

- Select and open the Notes folder.

- Rename the file. (format: ClientNumber.?iY)

Example: Let's say the client number is 1234. If the data path in step 2 is C:\Lacerte\23tax\IDATA, then browse to C:\Lacerte\23tax\IDATA\Notes, find 1234.ii9 and rename it. In TY20, a partnership file extension of .Pi3 will show.

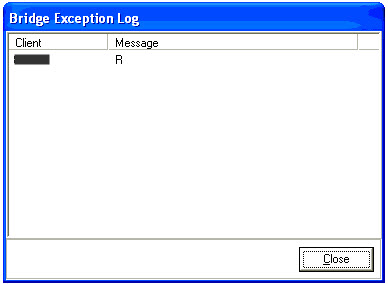

The Bridge Exception Log is showing R under Message

This usually means you have a REP Lock on an existing client.

- Open the current year of Lacerte to the Client list.

- Right-click on the client.

- Select Remove REP Lock.

- Go back to the prior year program and start the Proforma process once more.

When opening Lacerte or switching modules proforma starts

This happens when a Proforma is initiated from the prior year. It may have been done accidentally by another user. It can go unnoticed until the current year for that tax type is accessed. If the bridging has completed and work has been overwritten, the only way to get it back is to restore from a backup. There is no undo feature.

If the Proforma bridge was caught in time or to prevent it from going further, you can delete the bridge files.

Follow these steps to delete the bridge files:

- Close Lacerte.

- Open the directory of the Data Path for the year the files are proformaing to.

- Example for 2023 Individual standalone - C:\Lacerte\23tax\Idata

- Within this ?data folder, delete any file that ends in .?PY (? = letter of tax type, Y = last digit of tax year)

- Example for 2023 Individual file - client.IP3

- Once these files are deleted in each tax type's Data Path, open the program.

If this issue repeats itself on a network, it may be helpful to disable a user's ability to Proforma in Trustee Rights.

When opening Lacerte after a proforma Range Check errors show

This error is caused when there is minor damage to the database that the program is attempting to import the client to. Run a database repair to resolve the issue.

Related topics

More like this

- Failure during proforma processing or "failed to transfer" when attempting to proforma clientby Intuit

- Troubleshooting the Lacerte error: Error while updating Tax Service Databy Intuit

- Understanding why some client data did not proforma in Lacerteby Intuit

- Resolving Access Violation errors when opening Lacerteby Intuit