Common questions about generating corporate extensions with Form 7004 in Lacerte

by Intuit•1• Updated 5 months ago

Below, you'll find answers to frequently asked questions about generating corporate extensions.

- File extensions in Lacerte

- E-filing extensions in batches

- Extension Form and Filing instructions for forms 7004, 4868, 8868 are not printing in Lacerte

- E-file Reject F7004-904 for a business extension (Form 7004)

- Electronic filing deadlines and perfection periods for business returns

More like this

- File extensions in Lacerteby Intuit

- Common questions on fiduciary extensions (Form 7004/8868)by Intuit

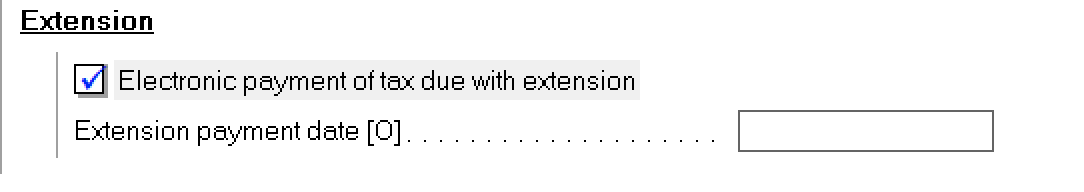

- Common questions about electronic filing of extensions in Lacerteby Intuit

- Common questions about S-Corporation Automatic Extension in Lacerteby Intuit

- Which mailing address to use for IRS Form 7004by Intuit