How to enter coronavirus-related retirement plan distributions in ProConnect Tax

by Intuit• Updated 6 months ago

This article will help you generate Form 8915E, Qualified 2020 Disaster Retirement Plan Distributions and Repayments (or Form 8915F for 2021 and 2022), and attach the completed form to your client's return for e-filing. These forms are used to report COVID-19-related distributions from an IRA or other retirement plan, like a 401(k). The taxable amount of qualifying distributions can be spread over three years.

Before you start:

Form 8915-F (Qualified Disaster Retirement Plan Distributions and Repayments) replaces Form 8915-E for 2021 and later years.

- Starting in tax year 2022, the IRS supports Form 8915-F as an e-file form. For years prior, completed Form 8915-F and 8915-E must attached as a PDF for e-filing.

- Qualifying coronavirus-related distributions made any time during 2020 can claim disaster relief.

To generate the 8915-F:

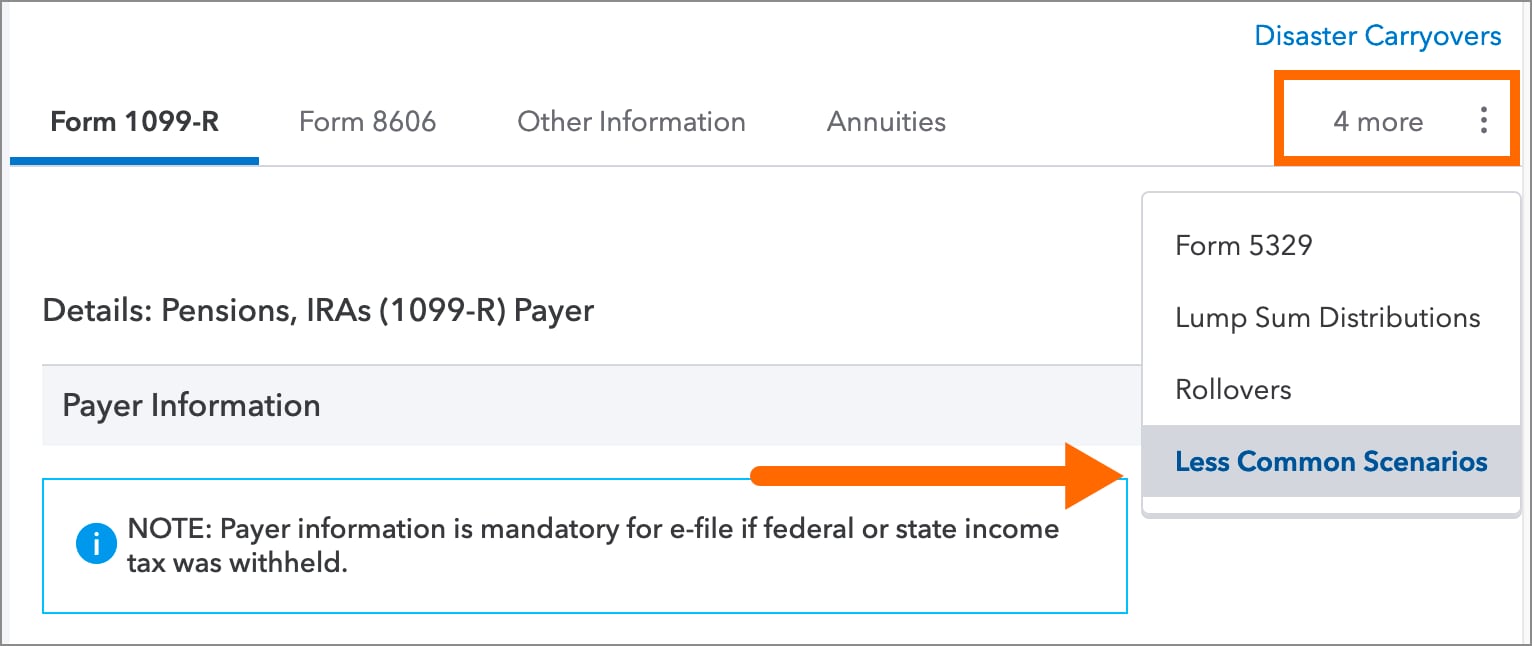

- On the left-side menu, select Income.

- Select Pensions, IRAs (1099-R).

- Click on the Disaster Carryovers hyperlink at the top right of the screen.

- Select the 2020 Disaster Distrib. section along the top of the input.

- Enter the amounts from 2020 Form 8915E.

- Enter a 1 in 1=disaster related to Coronavirus.

- Scroll down to the Other Than IRAs subsection.

- Enter the remainder of the information from 2020 Form 8915. Be sure to enter any Repayments made before filing 2021 tax return here or further down under the IRAs subsection.

ProConnect Taxwill generate Form 8915-F with your entries.