Common questions for California single member LLCs in Lacerte

by Intuit•23• Updated 10 months ago

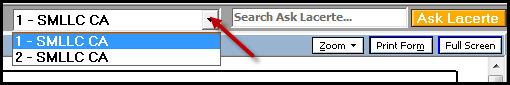

Below you'll find answers to frequently asked questions on California single-member limited liability companies (LLCs) in the individual module of Lacerte . For information about generating the 568 from the partnership module see Generating CA Form 568 in the partnership module of Lacerte.

![]() A return with the same EIN/SSN cannot be e-filed more than once. Each SMLLC has to have own EIN in order to be e-filed from Lacerte.

A return with the same EIN/SSN cannot be e-filed more than once. Each SMLLC has to have own EIN in order to be e-filed from Lacerte.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Common questions on California single-member LLCs in ProConnectby Intuit

- How to resolve the ProConnect Tax diagnostic Ref 16190 - There are multiple LLC entities present on this returnby Intuit

- Generating Kentucky Form 725 Single Member LLC in Lacerteby Intuit

- California LLC tax and fee calculation for Form 568 in ProConnectby Intuit