Common questions on Form 1040NR in ProSeries

by Intuit•11• Updated 1 month ago

Here you will find the answers questions commonly asked about Form 1040NR in ProSeries.

Before you start:

- The 1040NR isn't available in ProSeries Basic

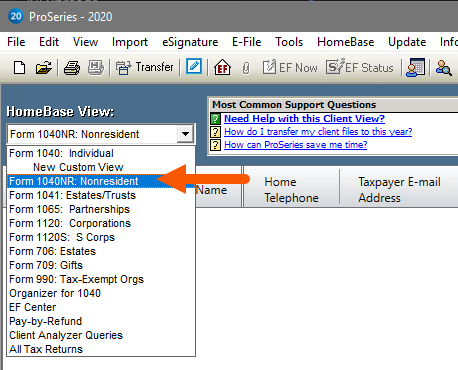

- The 1040NR is a separate HomeBase view from the Form 1040 Individual.

- To see if the 1040NR has been released for the current year, see the ProSeries Tax form finder.

How do you install the 1040NR?

- From the Update menu, choose Select and Download New Products.

- Under Federal Products check the Form 1040 NR box.

- Select Next to begin downloading and installing the 1040NR.

Accessing the 1040NR

Once the 1040NR module has been downloaded and installed into your ProSeries product, you can now access Form 1040NR returns from the HomeBase View dropdown menu.

Generating state returns in the 1040NR

Most state returns require manual entries within the state return and won't automatically flow entries from the federal return. Additionally, certain amounts won't calculate even when the necessary entries are present. Some fields will require using an override to make an entry. Most states prepared from the 1040NR will need to be paper filed with the state taxing agency.

ProSeries will calculate and flow information for the following states:

- Arizona

- California

- Hawaii

- Minnesota

- New York

- Vermont

Reporting capital gains and losses in the 1040NR

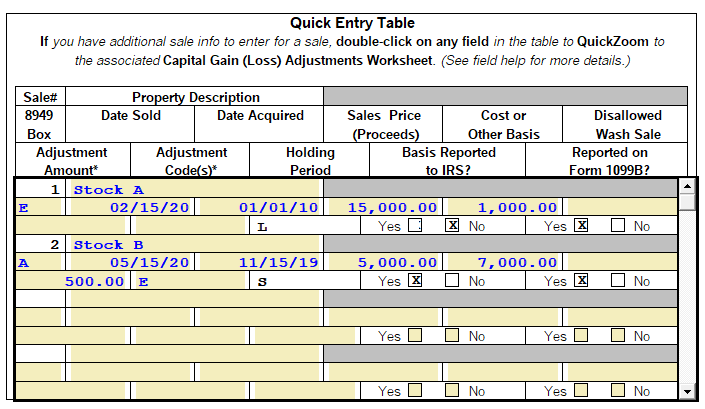

Starting in tax year 2020, the Schedule D itself will be populated from a new Form 1099-B worksheet. This worksheet is for any transaction other then HomeSales that would typically be entered on a Schedule D. The QuickZoom to the 1099-B worksheet can be found at the top of Schedule D.

- Open the Schedule D.

- Select the QuickZoom to Go to Form 1099-B Worksheet.

- Enter the Broker name and click Create.

- If a 1099-B was not received for the transaction check the box Transactions were not reported to IRS.

- Use the Quick Entry Table to quickly enter any transactions and simple adjustments from this broker.

- Property Description: Enter here the name of the company, mutual fund, or other asset sold.

- 8949 Box: The code entered here will populate the Basis Reported to the IRS question, Reported on Form 1099-B question and determine if the transaction is long or short term. See the table below for quick reference.

- Date Sold: Enter the date of sale in mm/dd/yyyy format. The IRS does not allow Various as a date sold, even if reported a summary of the stock. When applicable Worthless or Bankrupt can be entered.

- Date Acquired: Enter the date of acquisition in mm/dd/yyyy format. Other acceptable entries are Various or Inherited.

- Sales Price (Proceeds): Enter here the proceeds received as a result of this sales transaction. If the transaction is reported on Form 1099-B or equivalent statement, transcribe the amount from Box 2. Note: Box 2 also indicates whether the reported proceeds are Gross Proceeds or Net Proceeds (after reduction by selling expenses such as commissions and option premiums.)

- Cost or Other Basis: Enter here the cost or other basis of the asset sold. If this transaction is reported on Form 1099-B or equivalent statement, transcribe the amount from Box 3, if present; usually this is the purchase price plus any purchase expenses plus any selling expenses not included in Form 1099-B, Box 2. IRS Pub. 550or IRS Pub. 551 may help determine the proper cost or other basis amount, if necessary.

- Disallowed Wash Sale: Enter here any amount of loss disallowed due to wash sale restrictions. If this transaction is reported on Form 1099-B or equivalent statement, transcribe the amount from Box 5, if present.

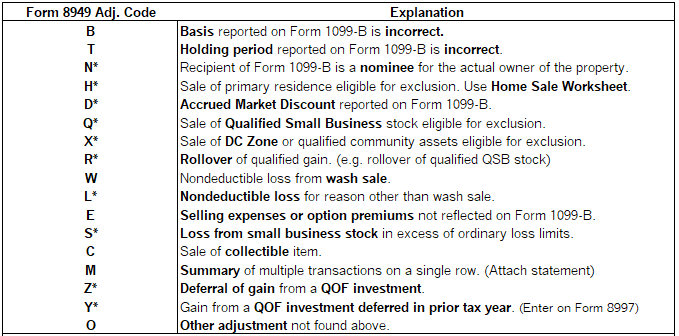

- Adjustment Code(s)*: If the code has an * you can enter the Adjustment Code and Adjusted Amount directly on the Quick Entry Table. If the code has an * double click on the entry to open the Capital Gain (Loss) Adjustments Worksheet.

- Adjusted Amount*: If the corresponding Adjustment Code does not have a * simply enter the adjustment amount needed and the corresponding adjustment code.

- Holding Period: The holding period will automatically generate based on the entry in the 8949 Box unless Code X is entered. If X is entered for the 8949 Box than manually enter an L for Long Term or S for Short Term in this box.

- Basis Reported to IRS?: This question will automatically generate based on the entry in the 8949 Box.

- Reported on Form 1099B?: This question will automatically generate based on the entry in the 8949 Box.

- If there are additional details for the transaction double click in any field to access the Capital Gain (Loss) Adjustments Worksheet. Adjustments would include:

- Tax Withheld.

- Employee Stock.

- Collectables.

- Qualified Small Business Stock exclusions.

- Qualified Opportunity Fund (QEF).

What code do I enter in the 8949 Box field?

| 8949 Box Code | Basis Reported to IRS? | Reported on Form 1099B? | Holding Period |

|---|---|---|---|

| A | Yes | Yes | Short Term |

| B | No | Yes | Short Term |

| C | No | No | Short Term |

| D | Yes | Yes | Long Term |

| E | No | Yes | Long Term |

| F | No | No | Long Term |

| X | No | Yes | Undetermined - the holding period will need to be manually entered |

To quickly create additional copies of the Form 1099-B Worksheet select the QuickZoom to another copy of Form 1099-B Worksheet located at the top of the form.

Amending a 1040NR return

Per IRS instructions, Form 1040X is used to amend Form 1040NR. While the IRS supports e-filing for Form 1040X, the Form 1040X isn't supported in the ProSeries Form 1040NR software.To amend the 1040NR, we recommend one of the methods below:

- Create a Form 1040 return for the client to manually prepare the Form 1040X using ProSeries. If preparing Form 1040 returns on a Pay-Per-Return basis, this will require authorization of the return before printing (e-filing Form 1040X isn't currently supported by ProSeries when the return is a 1040NR).

- Download the Form 1040X from the IRS website and manually prepare as needed.

Where is Form 1042-S income code 16 reported on Form 1040-NR?

Per the IRS Instructions for Form 1042-S:

"If you were a degree candidate, the amounts you used for expenses other than tuition and course-related expenses (fees, books, supplies, and equipment) are generally taxable. For example, amounts used for room, board, and travel are generally taxable.

If you were not a degree candidate, the full amount of the scholarship or fellowship is generally taxable."

Refer to the IRS Instructions for 1040-NR or IRS Pub. 519 for more information.

Per the Tax Help for Form 1040-NR, amounts entered on Line 13 of the Wages, Salaries, & Tips Worksheet will be reported on Form 1040-NR, Line 12.