ProSeries Due Diligence WorkSheets

by Intuit•3• Updated 1 year ago

ProSeries includes worksheets to help you and your staff record taxpayer responses to inquiries to accommodate the due diligence requirements. ProSeries Basic and Professional include the following Due Diligence Worksheets:

- Paid Preparer's Due Diligence Worksheet EIC

- Paid Preparer's Due Diligence Worksheet CTC

- Paid Preparer's Due Diligence Worksheet AOTC

- Paid Preparer's Due Diligence Worksheet HOH

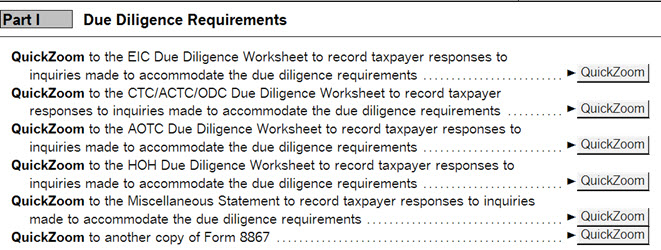

In addition to the Due Diligence Worksheets, a separate Miscellaneous Statement is also available to record taxpayer responses. Each of these worksheets and the statement can be easily accessed using the QuickZooms located at the top of Form 8867.

These worksheets are provided to assist in recording client responses and aid in record retention for due diligence purposes. The checklists contained in these worksheets shouldn't be considered a comprehensive or complete list. We encourage tax preparers to refer to the IRS instructions or the IRS website for due diligence requirements.