Entering Form 1099-DIV, box 3 in the individual module of Lacerte

by Intuit• Updated 7 months ago

You may have a Form 1040 client who has a 1099-DIV with box 3 populated, and need to report that in the program.

Down below we will we go over how you report that nontaxable distribution or tax exempt information on the individual return.

To enter 1099-DIV, box 3:

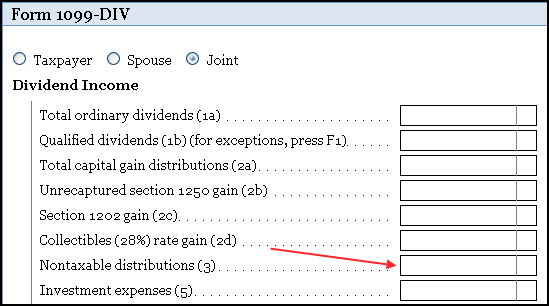

- Go to Screen 12, Dividend Income.

- Enter the amount from box 3 of the 1099-DIV in, Nontaxable Distribution (3).

- Box 3 of the 1099-DIV may describe the amount as "nondividend distribution," but this is still the correct input.