Turning off error checking for Electronic Filing in ProSeries

by Intuit•6• Updated 1 year ago

Before you start:

- There's no guarantee the return will be accepted when e-filed with the conversion error checking disabled.

- Disabling conversion error checking won't clear errors from the return. It merely ignores errors when e-filing.

- Disabling conversion error checking won't always successfully bypass the error, and in some scenarios the return will still fail to convert for an electronic filing.

- Disabling conversion error checking isn't recommended without direction from Technical Support.

There are times when you, as a tax preparer, may have made overrides within ProSeries to make necessary adjustments or corrections. ProSeries has an internal error check that may prevent such files from being e-filed. To e-file these returns, you must disable, or turn off, the Return Conversion Error Checking.

ProSeries Professional:

- Go to the EF Center.

- Select the client's federal, and state return if applicable.

- From the E-File menu, select Electronic Filing and then Convert/Transmit Returns/Extensions/Payments.

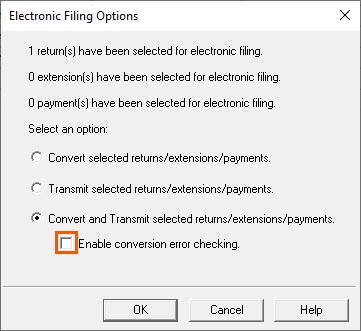

- On the Electronic Filing Options choose Convert and Transmit selected returns/extensions/payments.

- Uncheck Enable conversion error checking then click OK.

- ProSeries will try to convert and transmit the return.

- If the error remains then the error is too critical to bypass and the return may need to be paper filed.

- The Enable conversion error checking checkbox will re-check automatically for future returns.

ProSeries Basic:

- Go to the EF Clients tab.

- Select the client's federal, and state return if applicable.

- From the E-File menu, select Electronic Filing and then Convert/Transmit Returns/Extensions/Payments.

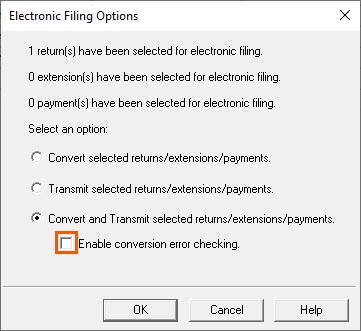

- On the Electronic Filing Options choose Convert and Transmit selected returns/extensions/payments.

- Uncheck Enable conversion error checking then click OK.

- ProSeries will try to convert and transmit the return.

- If the error remains then the error is too critical to bypass and the return may need to be paper filed.

- The Enable conversion error checking checkbox will re-check automatically for future returns.