Completing New York city corporate Form NYC-2.4 in ProSeries

by Intuit• Updated 10 months ago

This article will help you complete the Form NYC-2.4 Net Operating Loss Deduction.

Most of the fields on the NYC-2.4 will calculate automatically for you; however, there are some areas to check to review transferred information:

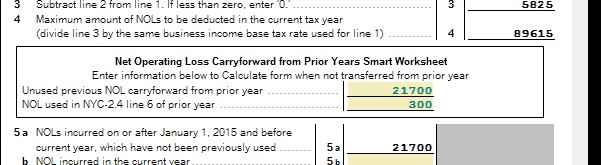

Net Operating Loss Carryforward from Prior Years Smart Workhseet:

If you are entering a new return that was not prepared in ProSeries last year you'll need to enter both of these items manually:

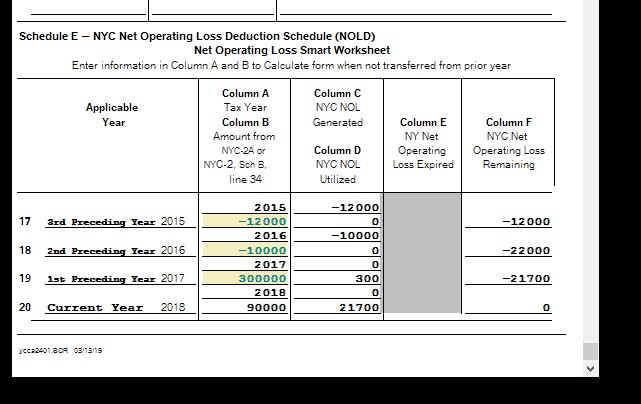

Schedule E - NYC Net Operating Loss Deduction Schedule:

This smart worksheet starts on line 17 and should show the history of the NOL starting in 2015. This worksheet is here to help track your NOL carryovers

- Column A – Enter your tax year

- Column B - Enter the amount from NYC-2, Schedule B line 34. Loss enter with a negative

- Column C - Will calculate the amount from Column B if a loss

- Column D - Enter the amount of NOL used in the year used. Note there will only be an amount in column D is you have income in Column B.

- Column F – Will show the Loss remaining. Amounts will be 0 or a loss.