How to enter asset depreciation in ProSeries

by Intuit•24• Updated 2 weeks ago

For more Schedule C resources, check out our Tax topics page for Schedule C where you'll find answers to the most commonly asked questions.

Before you start:

- ProSeries uses Asset Entry Worksheets to enter, and track regular depreciation, special depreciation, bonus depreciation and Section 179 taken.

- Each depreciable asset should be entered on a separate Asset Entry Worksheet.

- In the 1040 return, vehicles shouldn't be entered on the Asset Entry Worksheet. See the Completing the Car and Truck Expenses Worksheet in ProSeries for vehicle depreciation.

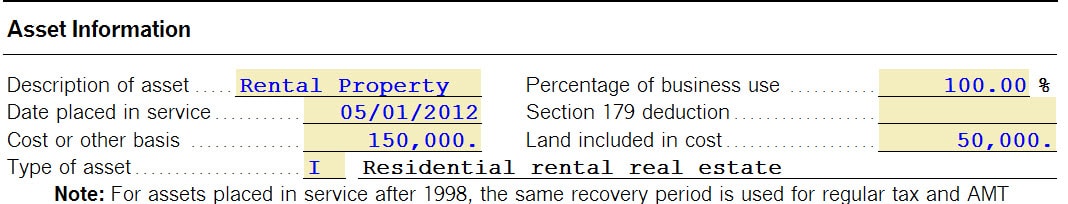

- Method of depreciation, Cost/Basis, and Date Placed in Service are required fields to depreciate an asset.

Creating an asset entry worksheet:

- Open the client return.

- Press F6 bring up the Open Forms.

- Type DEE to highlight Depr Entry Wks and click OK.

- To create a new asset under Create new copy enter the description of the asset and click Next.

- Under Activity Type select the type of business the asset is used for and click Next.

- If the business activity is one that supports multiple copies (such as the Schedule C or 8825), select the Existing Schedule/Form that the asset is used for and click Finish.

Different depreciation types

Section 179, part of the U.S. internal revenue code, allows business owners to take an immediate expense deduction when purchasing depreciable business equipment.

Bonus depreciation allows for businesses to reduce their taxable income by writing off a significant portion of the cost of eligible assets in their first year.

Special depreciation allowance is an extra allowance that you can take the first year a property (depreciated under the MACRS method) is placed in service. This additional allowance is automatically calculated unless you manually opt out of it.

For more info on these, see IRS Pub. 946

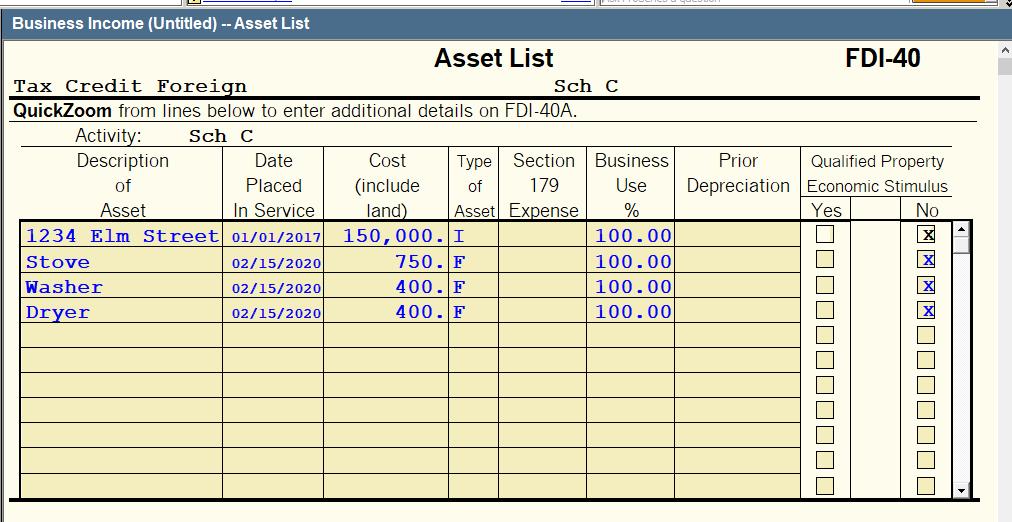

Entering asset entry worksheets using Quick Entry Mode:

If you are entering multiple assets in ProSeriesProfessional you can use Quick Entry Mode to enter the assets into a grid for faster data entry for Form 1040, 1120, 1120S and 1065. This feature is not available in ProSeries Basic.

Entering prior year data for a new client:

When you have a new client you are entering into ProSeries that client may have depreciation from prior tax returns. This section will help you enter that prior year information so ProSeries can continue tracking the depreciation going forward:

Entering disposition information for a depreciable asset:

Select a topic to see steps: