Understanding depreciation methods and conventions in ProSeries

by Intuit•2• Updated 10 months ago

This article can help you select a Depreciation Method.

For more depreciation resources, check out our Tax topics page for Schedule C where you'll find answers to the most commonly asked questions.

Before you start:

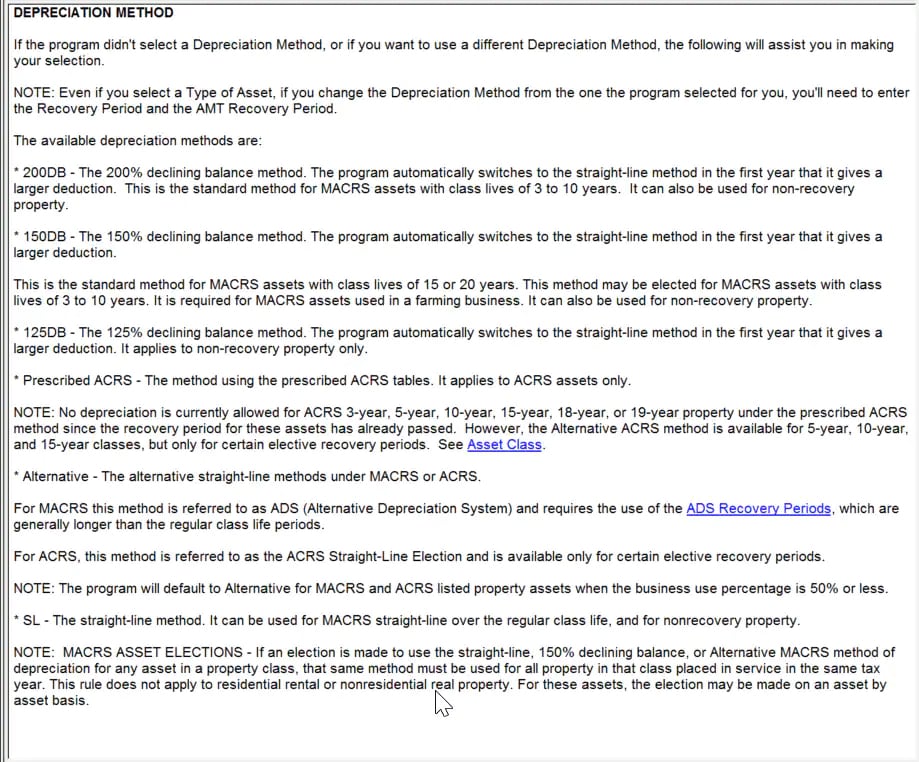

- Even if you select a Type of Asset, if you change the Depreciation Method from the one the program selected for you, you'll need to enter the Recovery Period and the AMT Recovery Period.

- If you use the Alternative Depreciation System, the ADS recovery periods will generally be longer than the regular GDS recovery periods under the MACRS depreciation system.

- The applicable convention determines the portion of the tax year for which depreciation is allowable during a year property is either placed in service or disposed of.

The following depreciation methods are available in the program:

- 200DB - The 200% declining balance method. The program automatically switches to the straight-line method in the first year that it gives a larger deduction. This is the standard method for MACRS assets with class lives of 3 to 10 years. It can also be used for non-recovery property.

- 150DB - The 150% declining balance method. The program automatically switches to the straight-line method in the first year that it gives a larger deduction. This is the standard method for MACRS assets with class lives of 15 or 20 years. This method may be elected for MACRS assets with class lives of 3 to 10 years. It is required for MACRS assets used in a farming business. It can also be used for non-recovery property.

- 125DB - The 125% declining balance method. The program automatically switches to the straight-line method in the first year that it gives a larger deduction. It applies to non-recovery property only.

- Prescribed ACRS - The method using the prescribed ACRS tables. It applies to ACRS assets only.

![]() No depreciation is currently allowed for ACRS 3-year, 5-year, 10-year, 15-year, 18-year, or 19-year property under the prescribed ACRS method since the recovery period for these assets has already passed. However, the Alternative ACRS method is available for 5-year, 10-year, and 15-year classes, but only for certain elective recovery periods.

No depreciation is currently allowed for ACRS 3-year, 5-year, 10-year, 15-year, 18-year, or 19-year property under the prescribed ACRS method since the recovery period for these assets has already passed. However, the Alternative ACRS method is available for 5-year, 10-year, and 15-year classes, but only for certain elective recovery periods.

- Alternative - The alternative straight-line methods under MACRS or ACRS.

- For MACRS, this method is called ADS (Alternative Depreciation System) and requires the use of the ADS Recovery Periods, which are generally longer than the regular class life periods.

- For ACRS, this method is referred to as the ACRS Straight-Line Election and is available only for certain elective recovery periods.

- The program will default to Alternative for MACRS and ACRS listed property assets when the business use percentage is 50% or less.

- SL - The straight-line method. It can be used for MACRS straight-line over the regular class life, and for nonrecovery properties.

![]() Asset elections for MACRS - If an election is made to use the straight-line, 150% declining balance, or Alternative MACRS method of depreciation for any asset in a property class, that same method must be used for all property in that class placed in service in the same tax year. This rule does not apply to residential rental or nonresidential real property. For these assets, the election may be made on an asset by asset basis.

Asset elections for MACRS - If an election is made to use the straight-line, 150% declining balance, or Alternative MACRS method of depreciation for any asset in a property class, that same method must be used for all property in that class placed in service in the same tax year. This rule does not apply to residential rental or nonresidential real property. For these assets, the election may be made on an asset by asset basis.

If you use the Alternative Depreciation System, the ADS recovery periods will generally be longer than the regular GDS recovery periods under the MACRS depreciation system.

Some of the more common ones are:

- 5 years - automobiles, taxis, light trucks, computers and peripherals

- 6 years - typewriters, copiers, fax machines, other office equipment

- 9 years - rental furnishings, distributive trades and services

- 10 years - office furniture/fixtures, cellular phones

- 12 years - video equipment, personal property with no class life

- 20 years - land improvements

- 40 years - residential rental and nonresidential real property

Follow these steps to depreciate an asset placed in service in the current year for a recovery period of 40 years:

- Open The Asset Entry Worksheet and complete the following fields:

- Description

- Date placed in service

- Any other applicable fields

- For the Type of asset, select type Z (Other) in business returns, or type O (Other) in individual returns.

- Scroll down to the Additional Asset Details section for business returns, or Detail Asset Information for individual returns.

- Use the dropdown menus to select the following values:

- Depreciation type = MACRS (this should already be selected)

- Asset Class = Residential rental real estate (R) or Non-Residential real estate (NR)

- Depreciation method = Alternate Method (ALT)

- The MACRS convention, Year of depreciation, Recovery period, and Depreciable basis should fill in automatically.

Follow these steps to depreciate an asset placed in service in a prior year for a recovery period of 40 years:

- Open The Asset Entry Worksheet and complete the following fields:

- Description

- Date placed in service

- Any other applicable fields

- For the Type of asset, select type Z (Other) in business returns, or type O (Other) in individual returns.

- Scroll down to the Additional Asset Details section for business returns, or Detail Asset Information for individual returns.

- Use the dropdown menus to select the following values:

- Depreciation type = Amortization

- Asset Class = Blank

- Depreciation method = Blank

- The MACRS convention, Year of depreciation, Recovery period, and Depreciable basis should fill in automatically.

There are three types of conventions. To select the correct convention, you must know the type of property and when you placed the property in service.

- HY - Half-year convention. This convention applies to all property reported on lines 19a through 19g of Form 4562, unless the mid-quarter convention applies. It does not apply to residential rental property, nonresidential real property, and railroad gradings and tunnel bores. It treats all property placed in service (or disposed of) during any tax year as placed in service (or disposed of) on the midpoint of that tax year.

- MQ - Mid-quarter convention. If the total depreciable bases (before any special depreciation allowance) of MACRS property placed in service during the last 3 months of your tax year exceed 40% of the total depreciable bases of MACRS property placed in service during the entire tax year, the mid-quarter, instead of the half-year, convention generally applies.

In determining whether the mid-quarter convention applies, do not take into account the following.

- Property that is being depreciated under a method other than MACRS.

- Any residential rental property, nonresidential real property, or railroad gradings and tunnel bores.

- Property that is placed in service and disposed of within the same tax year.

The mid-quarter convention treats all property placed in service (or disposed of) during any quarter as placed in service (or disposed of) on the midpoint of that quarter. However, no depreciation is allowed under this convention for property that is placed in service and disposed of within the same tax year.

- MM - Mid-month convention. This convention applies only to residential rental property (Form 4562, line 19h), nonresidential real property (Form 4562, line 19i), and railroad gradings and tunnel bores. It treats all property placed in service (or disposed of) during any month as placed in service (or disposed of) on the midpoint of that month.

The default method of calculating depreciation for ProSeries is the rate based on formulas—instead of the optional depreciation tables. The depreciation formula is computed based on information you transfer from the prior year tax program, entries made directly on the Asset Entry Worksheet, or entries made directly on the Car and Truck Expenses Worksheet. The optional depreciation tables may be used (see the IRS MACRS Depreciation Tables section below).

Prior depreciation affects the computation for the current year depreciation deduction. The program computes the depreciation rate and applies it to the remaining basis. If prior depreciation is left blank, the program uses the expected prior year depreciation deduction to compute remaining basis. Expected prior year depreciation is shown on the Asset Life History.

The Asset Life History:

To access the Asset Life History open the Asset Entry Worksheet and below the current Depreciation deduction you'll find the QuickZoom to Asset Life History.

- Shows calculations for prior and current year depreciation, based on the year the asset is placed in service through the year the asset is disposed of or fully depreciated.

- Uses current year's percentage of business use when computing all prior and future year deductions.

- Shows the amounts that should have been taken in prior years, if the percentage of business use was the same in those years.

To illustrate the calculations, for an asset purchased for $5,000, used 100% for business, and placed in service May 1, 2017:

- The formula for a MACRS asset using 200% declining balance method, and half-year convention is:

- [ (Acquisition Cost - Accumulated Depreciation) / Life in Years ] X 2 = Annual Depreciation

- Example 1

- $5,000 cost basis

- - $714 prior depreciation

- 7 year life

- x 200% accelerated method

- = $1,225 current year depreciation.

- Example 2 Same as the first example, except business use is 50% in 2017, and 100% in 2018.

- $5,000 cost basis

- - $357 prior depreciation

- / 7 year life

- x 200% accelerated method

- = $1,327 current year depreciation.

- Example 3 Same as first example, except asset disposed of in July 1, 2018.

- $5,000 cost basis

- - $714 prior depreciation

- / 7 year life

- x 200% accelerated method

- = $1,225

- / 1/2 for year disposed

- = $612 current year depreciation.

- Example 4 MACRS vehicle using 200% accelerated method, and half-year convention. The vehicle was purchased for $35,000, used 100% for business, and placed in service March 1, 2018.

- $35,000 cost basis

- - $0 prior depreciation

- / 5 year life

- x 200% accelerated method

- = $14,000

- / 1/2 for first year = $7,000

- $3,160 current year depreciation, maximum allowed (luxury limit)

IRS MACRS Depreciation Tables

Instead of using the depreciation formula, you can use the IRS MACRS depreciation tables for an asset. On the Asset Entry Worksheet, under the Detail Asset Information section, enter an "X" in the Yes box after Use IRS Tables for MACRS Property? When you use the table, you don't reduce the basis by prior depreciation, so your entry for prior depreciation has no effect on the calculation of the current year depreciation deduction.

Once you select to use the tables, you must continue to use them for the life of the asset, unless there is an adjustment to the basis of the property for reasons other than:

Depreciation allowance, or Addition or improvement to the property that is depreciated as a separate asset.

For example, a reduction in basis due to a casualty loss would require you to stop using the tables.

Short Year

Another reason that the depreciation won't match tables is if the return is for a short tax year. The relative time periods (months/quarters/half-year) shrink proportionately. An asset placed in service 02/12 would normally be considered in the second month for MM. However, if the short year started February 1, this would still be the first month for MACRS and the depreciation amount be different by the one month.