- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello

I need some advice, I have a LLC (1 owner) last year a new accountant filed my taxes using a 1065 form and the irs sent me a paperwork that something was wrong and when I called they said that I need to file a 1120s .

my company is an LLC ( 1 owner) I was always filing using an schedule C however when I asked my accountant he said that everyone was getting the form because the irs made some changes but I think he is wrong….

My company have 1 owner only and I should file a schedule C , when explained to the irs they told me to file a 1120 I don’t understand neither 😕 Maybe I didn’t explain it correctly.

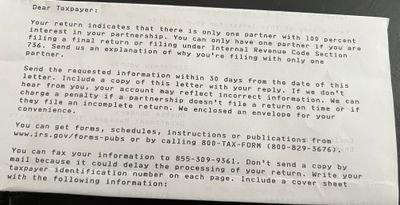

now the letter I attached say to contact them and let them know but I never did because like I mentioned above the accountant told me is ok… what should I do for this year ? Because the bank for a house loan told me that I should file 1120 to save some money instead of schedule C but the accountant is telling me that He can’t do 1120 until the irs give me an authorization:/ so confused

also if I filed the 1065 form for and was incorrect did I pay less or more taxes ? Should I admend do or just leave it ?

Best Answer Click here