- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As a taxpayer, I'm unable to accept the Intuit Link invite from my accountant. When I click the link from the invite email and log in, Intuit Link still says I need to be invited by my accountant. The email address I'm using to log in is the same as from the invite. My accountant doesn't know how to fix the issue. I have found what appears to be a similar question on this forum, but the link to the solution is no longer available.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IntuitBettyJo has a content team to hunt down stuff that ain't there any more. Contact your accountant about alternative methods of contact in the meantime.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

Here is what I was able to find:

Taxpayer Intuit Link Message - First, You'll Need to Ask Your Accountant to Invite You

Description

A taxpayer is invited to Intuit Link by their accountant and when the taxpayer logs in to Intuit Link, they see the following message instead of seeing the tasks/questions their accountant has sent them.

Hello there!

You've found Intuit Link.

As a taxpayer, you'll be able to easily gather and share your tax documents with your accountant. But first, you'll need to ask your accountant to invite you.

If you've already been invited by your accountant, then sign out and sign in with the email address your accountant used to invite you.

Thanks for stopping by!

Resolution

This issue can occur if the taxpayer signs into Intuit Link using a different email address than what their accountant sent the invitation to.

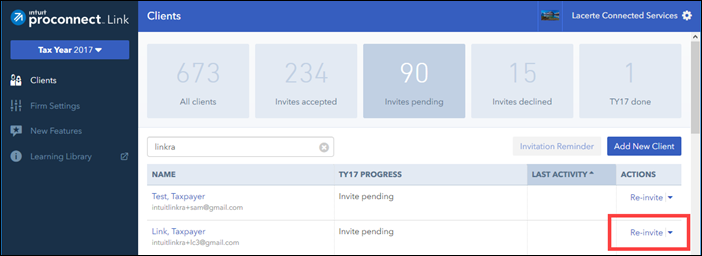

To resolve this issue, the accountant needs to sign into their Intuit Link portal at https://link.intuit.com/accountant and verify the taxpayer's Link status and email address.

- Login to the Intuit Link for Accountants portal.

- Find the client on the Client list.

- What is the taxpayer's status under the TY?? Progress column?

- Follow the steps below for the appropriate Link status.

Taxpayer's Link Status is "Invite Accepted"

If the status is "Invite accepted", click the client's name to verify the email address the taxpayer should be using for Intuit Link.

To view the email address,

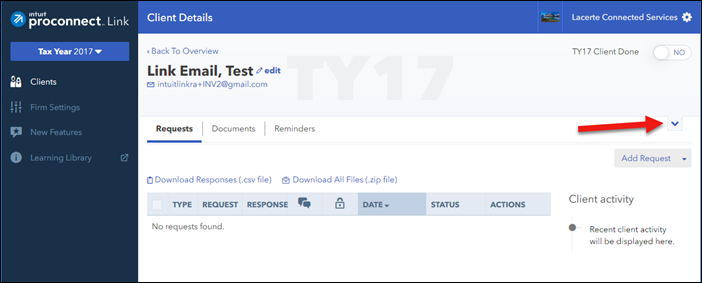

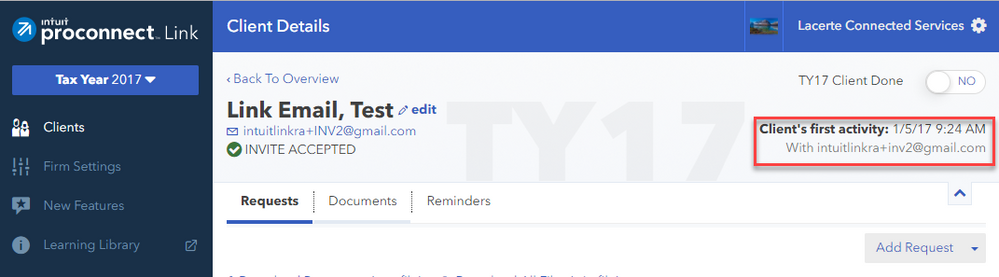

- Click on the client's name on the Intuit Link client list.

- Then click the arrow on the right of the screen.

- The email address the taxpayer used when they accepted their invitation will be displayed under the Client's First Activity section.

- Instruct the taxpayer to login to Intuit Link using the email address that is displayed under the Client's first activity section.

NOTE: If a taxpayer is logging into Intuit Link using a different email address than what is displayed under the "Client's first activity" section, they will not see the tasks their accountant has sent to them via Intuit Link.

Taxpayer's Link Status is "Invite Pending"

If the status is "Invite Pending":

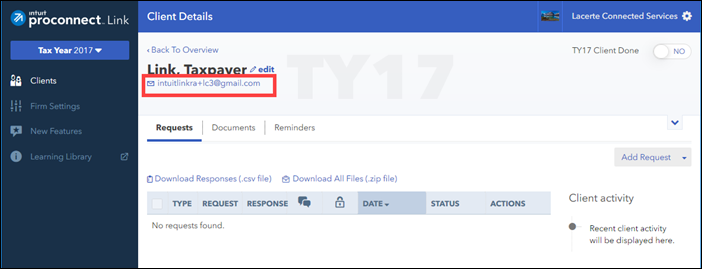

- Click the client's name on the Client list to open the client and verify the email address.

- Verify the client's email address displayed in Intuit Link is the same email address the taxpayer is using to log in to Intuit Link.

If the email address is NOT the same:

- the accountant needs to contact the taxpayer and inform them of the correct email address to use when logging in to Link

- Change the taxpayer's email address to the preferred one.

- Click the Edit button next to the taxpayer's name and change the taxpayer's email address.

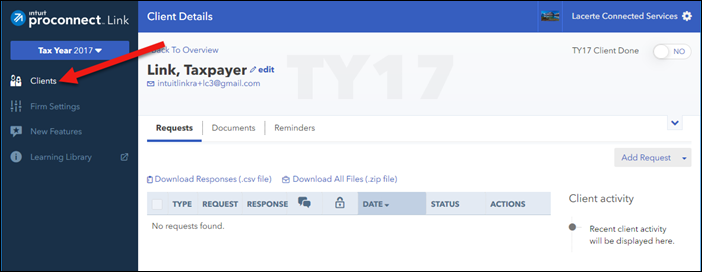

- Then click on Clients on the left menu.

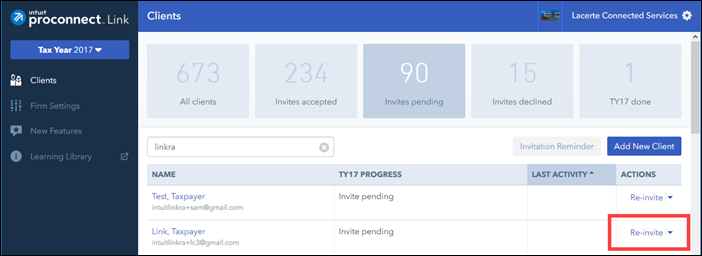

- Find the client on the Client list.

- Then click Re-invite under the Actions column.

- Then ask the taxpayer to go to their email's inbox, accept the invitation, and sign in to Intuit Link

If the email address is the same:

- Click on Clients on the left menu.

- Find the client on the Client list.

- Then click Re-invite under the Actions column.

- Then ask the taxpayer to go to their email's inbox, accept the invitation, and sign in to Intuit Link.

Hope this helps!

-Betty Jo