- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Entering 2 or more W2s for the same person with total SDI between the 2 exceeding the limit, should flow any excess over to the correct line of the return.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The Ca website isn't working today, but I searched the web for you (don't forget these functions) and found this:

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If the excess is from ONE employer, it won't "flow over".

The excess will have to be refunded by the employer that made the mistake.

And the limit is per person, so make sure you have the W-2's coded correctly to taxpayer/spouse if applicable.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, (3) separate W-2s to taxpayer all coded correctly.

I have tried inputting SDI into W-2 input boxes 14 Other, 19 and 15. Excess SDI does not flow through from any of those inputs.

There is an override for excess SDI - but if used, you cannot e-file the CA return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It works for Lacerte...and it sounds as if you are inputting the info correctly.

Paging our PTO guru @itonewbie

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am using ProConnect Online not Lacerte. So far, no post has answered my question.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I understand that... Lacerte is PTO's big sister.

AND PTO is "proconnect on-line"

AND Jensen is our resident expert; he'll wander by when he wakes up

Sorry "no one has answered your question". You do realize this is NOT Intuit/PTO support... we are all just fellow tax preparers.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

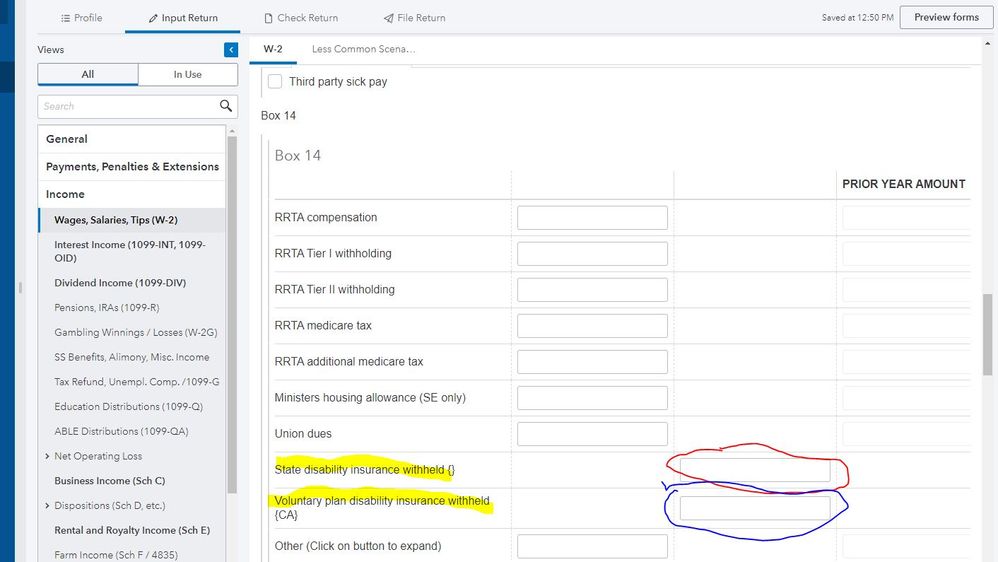

Be careful that each W-2 is properly recorded to either taxpayer or spouse. For each W-2 enter the SDI or VPDI in the boxes shown in the image. The program will add them all up and apply any excess over the maximum SDI to line 74 of the 540.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Guess I need to remember you are a PTO speaker too 😁

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

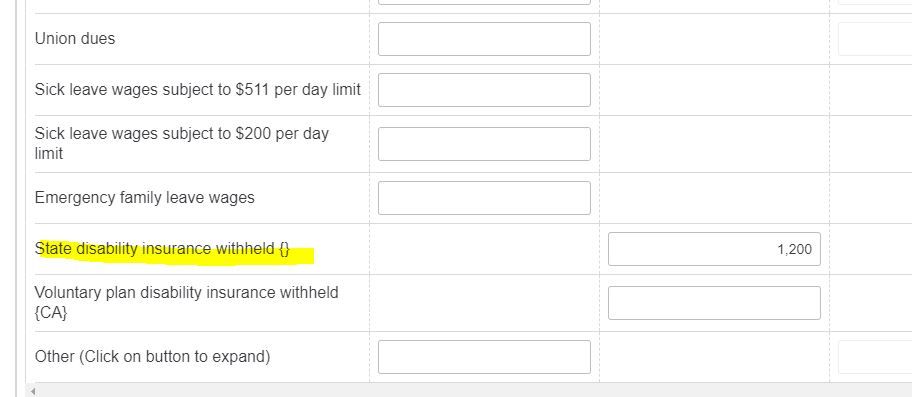

Yep, as George says, PTO works. Anything in excess of $1,183.71 by multiple employers for 2019 will be credited on CA 540/NR.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I found this thread researching the same issue. I have 2 clients, both with 2 x W2s, and they both have excess SDI. I entered the 2 x W2s and coded them properly taxpayer / spouse and can clearly see when I go to Preview Return > Worksheets that the amounts in the SDI column exceed 1229 for both taxpayer and spouse. Nothing is flowing through to the CA 540 return line 74. When I override, I receive a diagnostic that I have to paper file.

I cannot imagine that this is correct because it is a simple calculation that is very common. PTO support was not very helpful - I was told if I thought the program should do something different I should post it in the "idea exchange". Looking at this thread, the program is not behaving the way it should. Is anyone else having this issue?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The input is in this box

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That is where I am putting it. I posted on the PTO Facebook group and others have seen and replicated this same error. One person said they were given this workaround:

(a) click multi-state in client screen...i know that may not be correct but do it

(b) go back to w2 screen and scroll to your SDI input....then manually make CA in the dropdown.

It worked, but should not be required. This is very common and a simple calculation that should be done automatically so that when we are busy with dozens of returns we do not miss it. For my clients it resulted in a $500 savings in CA tax.