- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello everyone,

I have about $25k in section 179 depreciation that was reported on Form 4562, and was carried to Line 14, of Form 1120S (1st page). I found an article that says depreciation expenses should not be deducted by the S Corporation, instead, it should be reported on the shareholders Schedule K-1, line 11, is this true?

If yes, then why ProConnect allowed this deduction, and what do I need to do to remove the amount from line 14, and how to post it on line 11 of schedule K-1, and do I need to do any reconciliation on section K, or M1-M2 of form 1120S?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The amount shown on line 14 has two components, regular depreciation (section 179), and bonus depreciation. If you say that bonus depreciation is deducted on line 14, then why the section 179 was included too by ProConnect? Also, could you please answer the rest of my questions if you can?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I took a look again, M-1 did not reflect any depreciation reconciliation.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Maybe you want to take a second look at your input and check the business income limitation computation?

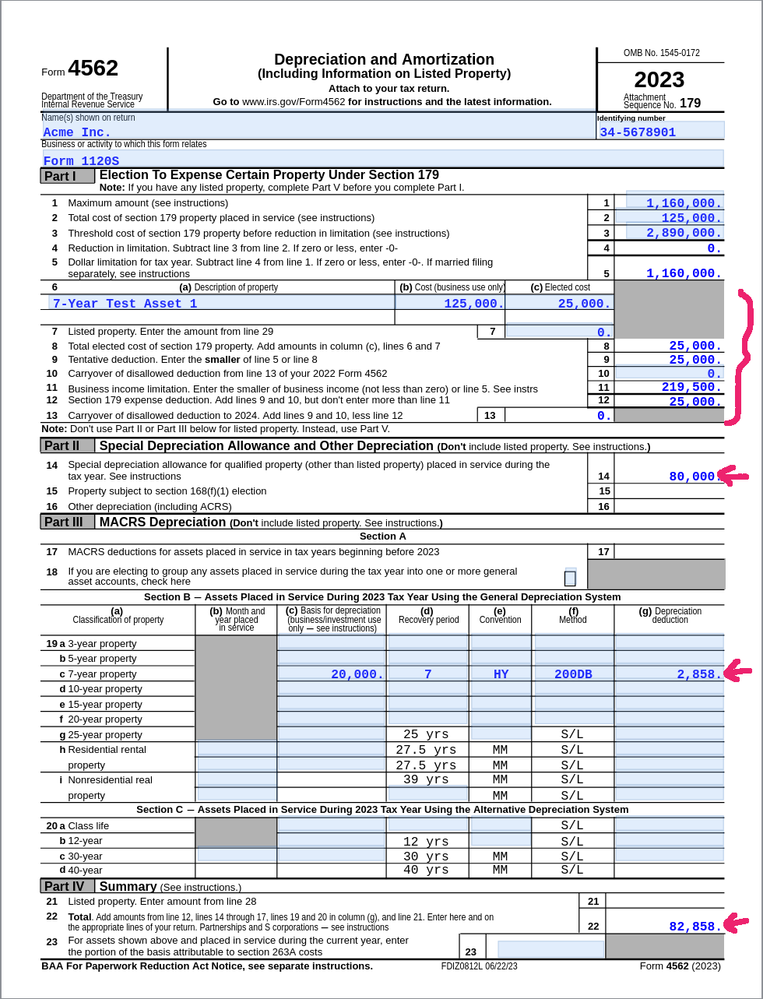

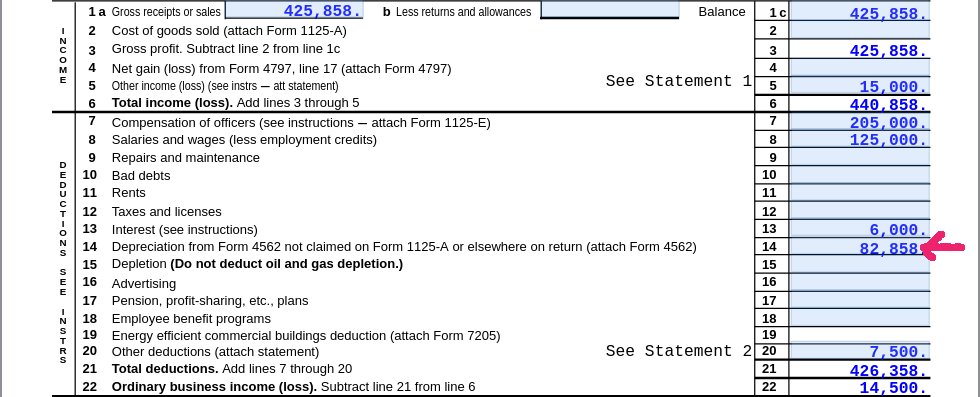

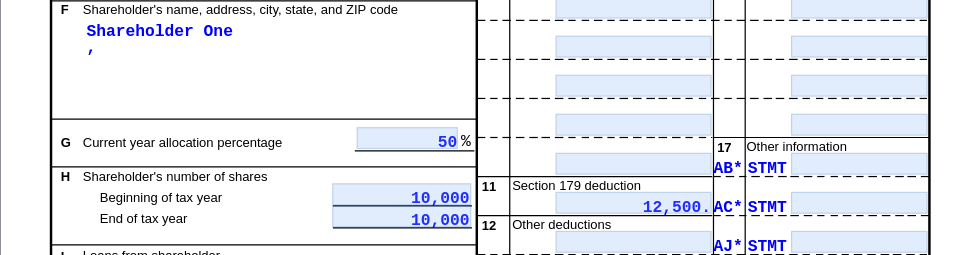

As you can see from these screenshots attached, ProConnect Tax does compute and present 179, bonus depreciation, and regular depreciation correctly:

- Total of bonus and regular depreciation: F.4652, Line 22 to F.1120S, Line 14; and

- 179: F.4562, Line 12 allocated to K-1, Line 11 of each shareholder.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN wrote:

I wish you wouldn't have disclosed my tax ID number. Before you know it, this place is going to be overwhelmed with counterfeit anvils.

Oops, my bad. I'll make it up to you by catching beep beep for you some day.

Still an AllStar