SLM Financial Services

Level 2

04-11-2023

04:31 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

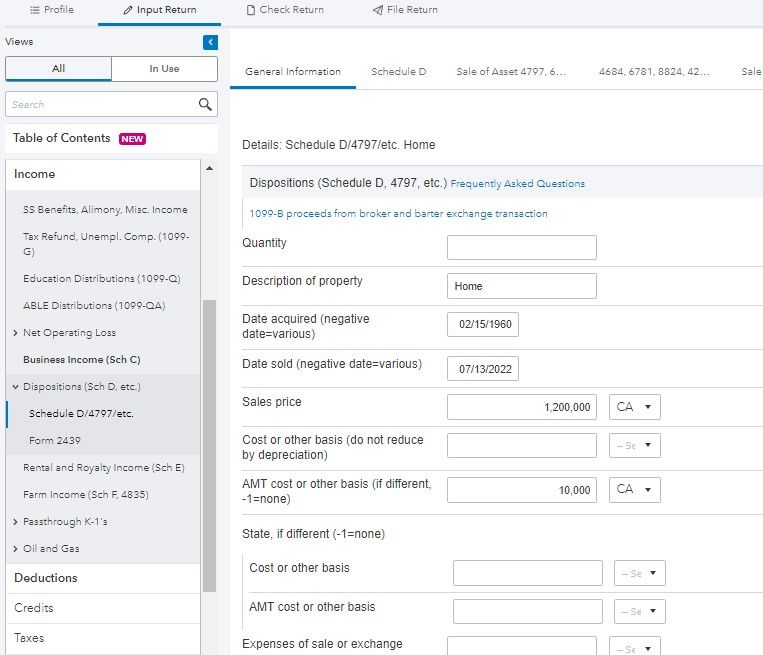

I have a client whose primary residence is in Washington state, but they sold the condo in CA in 2022 with capital gains to report. Where do I find the input to get a nonresident CA tax return to generate. I can get a CA resident return, but no matter how I complete the nonresident input screen, it does not change.

Labels

George4Tacks

Level 15

04-13-2023

07:14 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Client Information - Resident state WA - CHECK Full Year Resident - CHECK Multi-State

All information should be as you would normally do for a WA resident, Use the + to assign the sale of home to CA - this is how it starts

Answers are easy. Questions are hard!

George4Tacks

Level 15

04-13-2023

07:16 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Also do the input of State & Local > Part-Yr/Nonres info for the two sections for CA

Answers are easy. Questions are hard!