WCCPA

Level 1

01-25-2022

12:44 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Noticed today that schedule K-2 foreign tax paid is not flowing to the calculation of taxable income, and therefore resulting in Sch L not balancing diagnostic. Anyone have the work around for this or know when this will programmed into the software? It's a legitimate payment and in the past (old Sch K line 16) reduced the taxable income for purposes of M-1 and Sch K.

Labels

Employee

01-25-2022

03:26 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

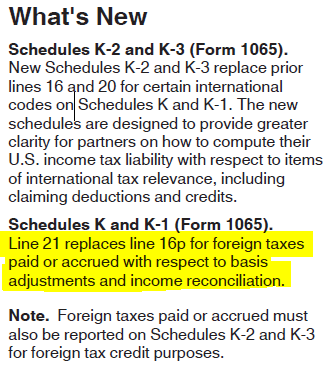

Please see the screenshot below from the Form 1065 instructions. For tax year 2021, Schedule K Line 21 has replaced what was formerly Line 16p for foreign taxes paid or accrued. Therefore, amounts for foreign taxes paid or accrued should be entered on Schedule K Line 21 in order for those amounts to flow into the calculation of taxable income.