ashburn

Level 1

10-07-2021

12:10 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi,

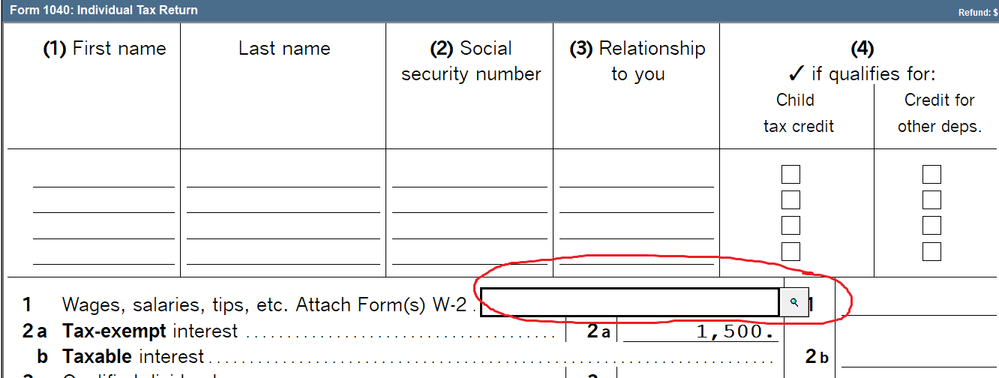

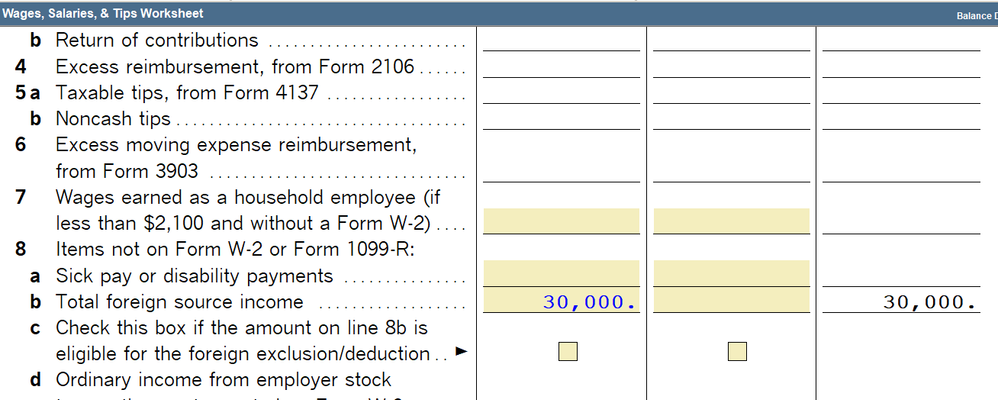

I reside & work overseas. I am claiming form-2555 and form-1116. My foreign employer doesn't have a EIN, and I would like to report my foreign wages on line#1. I tried putting under W2, but keep getting error missing EIN (foreign employer doesn't have a EIN).

Need assistance (preferably screenshots) on how to put my foreign employer compensation on line#1.

Thanks.

Best Answer Click here

Labels

Level 15

ashburn

Level 1

10-07-2021

09:20 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for the screenshots.

Do I need to enter the foreign employer address or country? If Yes, where to put?

Thanks.

Level 15

10-07-2021

09:46 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't do any returns with foreign income so I cant answer that, I just knew where the $ entry spot could be located.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪