EFCPA

Level 1

03-14-2021

10:49 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

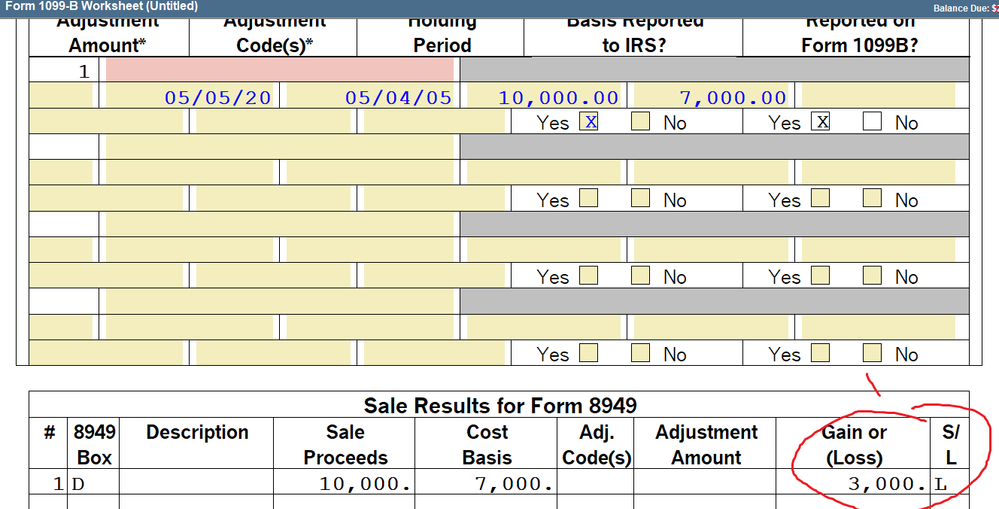

Is anyone as frustrated as I am with the results being generated when you enter transactions on 1099 B worksheet? It's bypassing the 8949 detail and putting them on Schedule D in a lump sum instead of showing the detail on 8949. Tech support says that this is in compliance with IRS requirements, but without details on the 8949 of every entry on the 1099 B worksheet, you have to do a separate side reconciliation to make sure that everything is picked up. Plus, your client cannot see the detail on the return. I truly think that there is a programming issue on Pro Series side.

Level 15

03-15-2021

04:57 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you put them in those top boxes that say NO 8949 needed, thats what happens.you get no 8949

If you scroll down below that box and enter the sales in the entry worksheet, then you get the 8949. Yes the net gain/loss from the sale is missing from the entry line, but scroll down just a bit further and it will see each line with the gain or loss.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪