- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

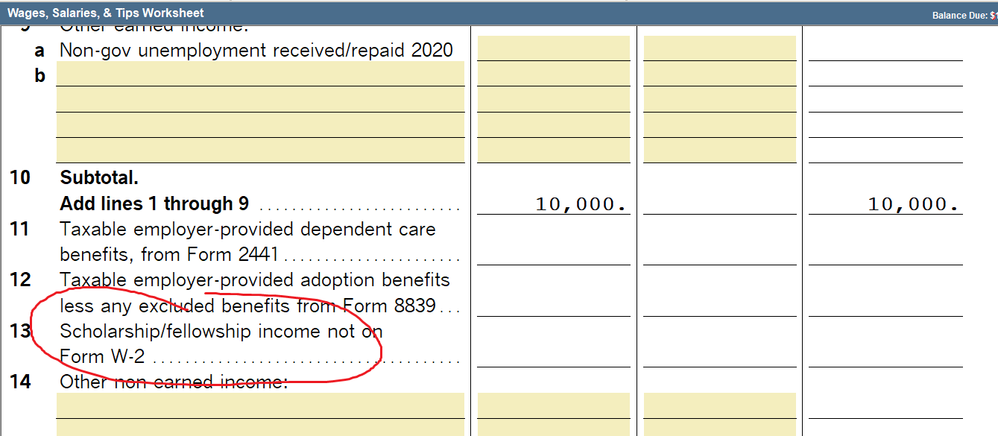

STIPEND payment are not not considered wages and are made to help defray living expenses while the participants is engaged in the research participation program at CDC. it is considered non qualified scholarships and fellowships (not tuition and fee)

Best Answer Click here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lisa, is that field enterable? Usually the white boxes flow from somewhere else. In the past I've just included this in the taxable scholarships through the 1098-T/Education Credit process and then it flows from there. Not sure that's the correct treatment but I've not had a return where it might impact other calculations (EITC, etc.) so it didn't really matter as long as we got it into AGI somewhere.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

LOL)....Oh! youre right, it comes from the student worksheet.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I would be concerned about the lack of a 1099. Some government-funded health-related fellowships are tax exempt. "You don't need to include in gross income any amounts you receive for services that are required by the National Health Service Corps Scholarship Program, the Armed Forces Health Professions Scholarship and Financial Assistance Program, or a comprehensive student work-learning-service program (as defined in section 448(e) of the Higher Education Act of 1965) operated by a work college." On the other hand, the government is pretty good at sending out 1099's when required. Has the taxpayer asked the program managers about it? I'm sure others have had the same question.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For some reason colleges and universities seem to be "above the law." No 1099 required for these "research" stipends/fellowships and they're not subject to employment taxes either. All doctors and lawyers are tax cheats and have to be given 1099s but all university students will of course voluntarily report these things properly on their tax returns without any tax forms whatsoever.

If it's a non-US person, there is an income tax w/h requirement and a reporting requirement (1042-S) but nothing has to be done otherwise. Here's a quick example from the GWU website:

https://taxdepartment.gwu.edu/taxation-scholarships-fellowships-stipends-0

Rick

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

CDC is not a college or university.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

thank you very much for your help. Please tell me where I can get the form that you show me.

I really appreciate it

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Lisa,

Please tell me how to enter the expenses so that the taxable income will be reduced. thank you Lisa

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is no Expense to enter for living costs. Life isn't a tax deduction.

You stated this: "to help defray living expenses while the participants is engaged in the research participation program at CDC. it is considered non qualified scholarships and fellowships"

Nonqualified typically means "taxable because no exception is made."

Don't yell at us; we're volunteers