proezeen

Level 1

02-21-2021

08:24 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello,

I filed my client's federal tax return electronically on Feb 18, 2021.

And other customer's tax return were filed electronically on Feb 20, 2021.

The second client's e-file status was confirmed in 10 minutes, while the first client's e-file status remains the same.

The only difference between the two tax returns is that the first client has stock transactions.

Does anyone have this experience?

What should I do?

Labels

Level 15

02-21-2021

08:39 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

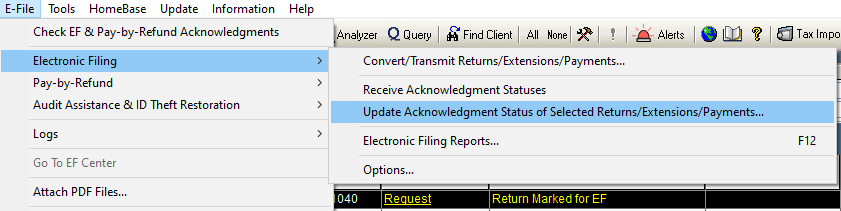

Highlight the files in the EFcenter, then use this, see if that pulls the acks in.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

proezeen

Level 1

02-21-2021

10:02 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Lisa, thank you for your reply.

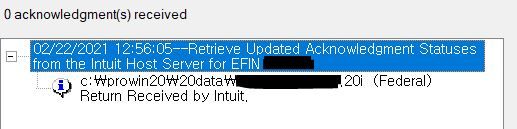

I have already done that several times and I just did it again.

It keeps showing that message.