- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

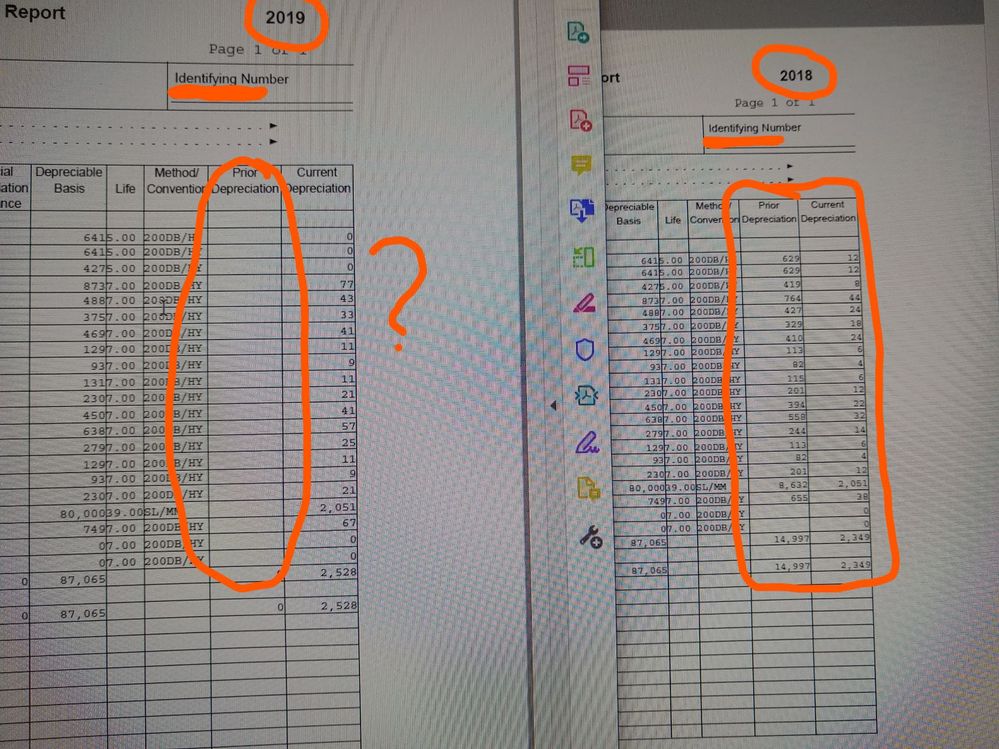

I wonder what happened in a tax file that isn't showing prior depreciation in 2019 when I've had this client and transferred the file from 2018 to 2019. The client is just now making the depreciation entries that I gave them and is asking why my depreciation goes beyond the cost she has recorded. This is when I noticed that there is no prior depreciation.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No clue why or how it happens.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sounds like a software problem.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I would like Proseries/Intuit to accept this as my bill for 3 hours of my time trying to figure his one one out only to come to the realization that there is no fix and no one knows why it is happening. I may need to amend my client's returns WITHOUT charging them. I will only charge you $75 per hour, so someone please contact me to either credit my account or send me a check for $225. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"...I may need to amend my client's returns WITHOUT charging them."

Meaning you did not check that depreciation (current AND prior) was correct?