- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Want to change child, can be claimed by someone else, her mother. but I couldn't and I tried to override but couldn't. How can I change it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Paper file, claiming the kid, is your only option. Eventually the IRS will contact both, & get it straightened out..... but do NOT hold your breath for a quick resolution.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Re: Change that the individual can be claimed by someone else, I tried to override but could not do it."

Did you Efile it and it got rejected? What are you trying to override?

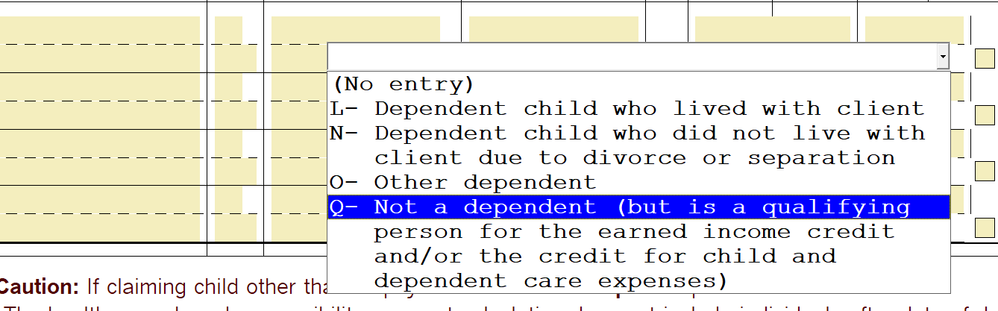

If the child is being claimed by the other parent, but your client still qualifies for HOH since the child lives with them, then you need to mark it with Code Q in the dependent entry section. If the child is being claimed by someone else and your client cannot claim them at all, then you need to delete the dependent (right click on the dependent line and choose Delete Line)

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good mind reading, Lisa....

IF it's really PS - I'm not sure.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do you have the boxes checked correctly on the Federal Worksheet? "Can this person be claimed by someone else". "Was this person claimed by someone else"? "Is this person claimed for EIC by someone else". If they are all "NO" answers and checked correctly, it should work. Or all checked yes, if claiming the child.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@abctax55 wrote:

Good mind reading, Lisa....

IF it's really PS - I'm not sure.

Im not sure I really understand the problem...I just took a guess LOL Oh thats true, this may be a TT post

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪