ramras_8

Level 3

03-12-2020

09:30 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My client has two W-2s and both are showing the maximum limit of $19,000 contribution to 401K. How is the excess reported on the return and which form do you enter the excess.

Labels

dascpa

Level 12

03-13-2020

08:33 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have the excess distributed by 04/15/2020 or else there is a 50% penalty on Form 5329.

sjrcpa

Level 15

03-13-2020

09:01 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The excess is reported as taxable wages.

The more I know the more I don’t know.

Level 15

03-13-2020

09:44 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

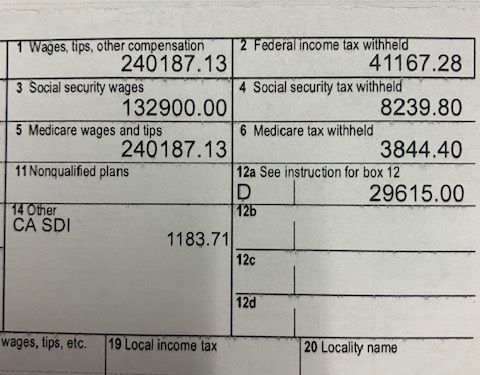

Just got this W2 the other night, Ive got a email into their payroll department asking WTF?! Retirement box is not checked, Im hoping that the D should have been a DD.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪