- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Group,

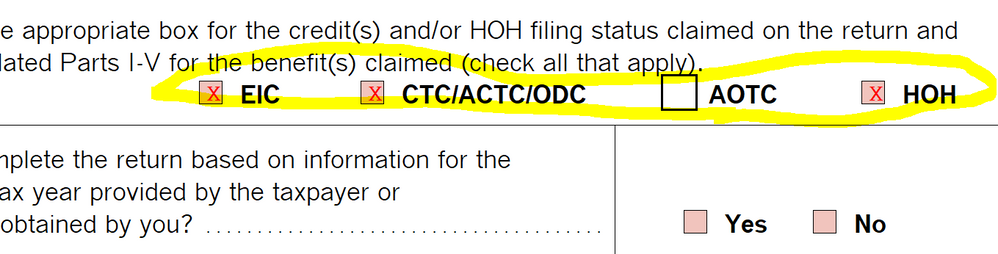

I am new to the ProSeries group and we are having a bit of an issue with the form 8867 populating correctly.

Even when I check the HOH box and the EIC box, the remainder of the boxes still remain red. Even, if we check off every single box in the first section, it still shows them all red. Am I doing something wrong? Did I miss something on the info worksheet?

Thank you in advance, Faith!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I really wish these auto marked themselves, its kind stupid that we have to play with the boxes back and forth.

If youve marked them as HOH and a child has been marked as dependent, CTC and HOH will for sure need to be checked, are you sure they have EITC computing on the return? no college age children that qualify for AOTC?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Lisa,

Thank you for replying. The income is $44K so the EIC should apply for his 10 yr old child. But I do not see this so I am bit frustrated about how to go about these boxes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is an owners draw on SCH C counted as part of the total income for the tax year?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

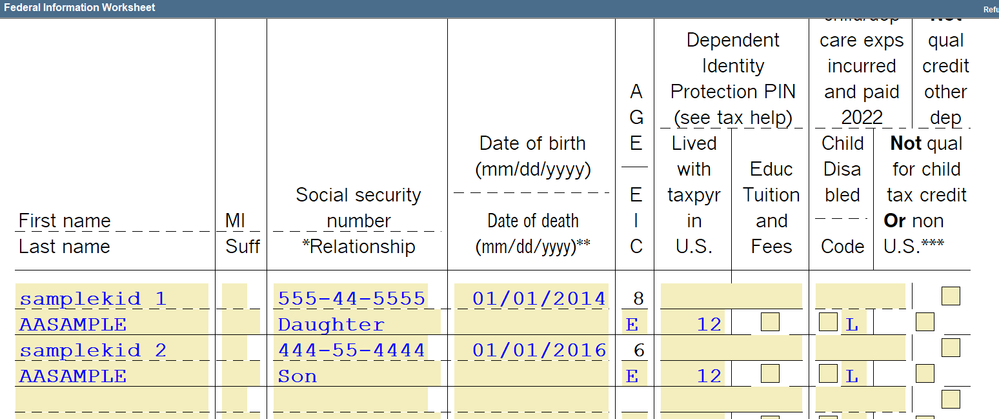

On the federal information worksheet, make sure youve marked the correct codes on the dependent line.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sch C needs a net profit on Line 31 that's the amount of "earned" income. It also take AGI into account. You may want to follow scroll through the EIC worksheet and follow the money.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes the info worksheet is correct

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Faith R wrote:

Is an owners draw on SCH C counted as part of the total income for the tax year?

Owners draw doesn't appear on Sch C or the tax return anywhere.

The profit at Line 31 is their "earned income".

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪