Generating the 2020 Unemployment Compensation Exclusion in ProConnect Tax

by Intuit• Updated 3 months ago

Unemployment Compensation Exclusion was not extended further, meaning it only applies to tax year 2020.

As part of the American Rescue Plan, the first $10,200 worth of unemployment payments are now tax-free for households with modified adjusted gross incomes less than $150,000. This expanded tax relief was for tax year 2020 returns.

How does ProConnect Tax handle the exclusion?

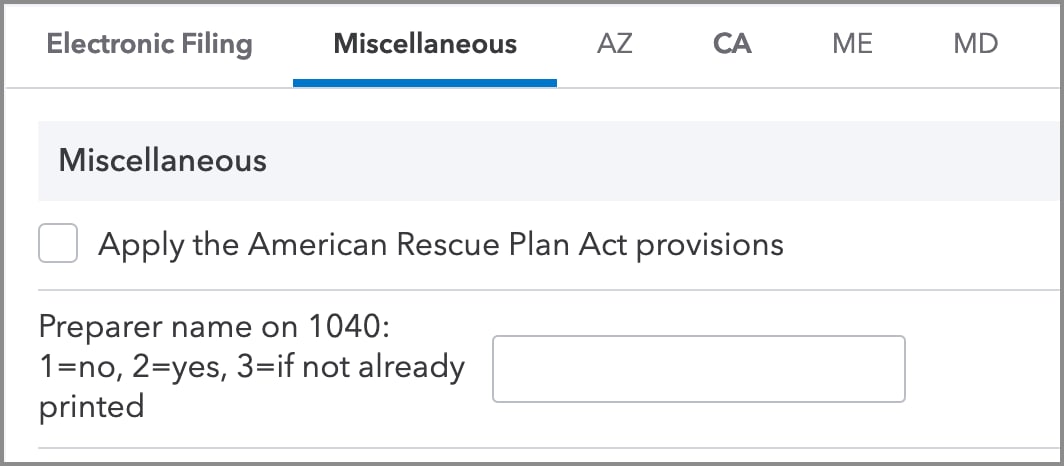

We added a checkbox to the Misc. Info./Direct Deposit screen to Apply the American Rescue Plan Act provisions. This will allow you to apply the provisions on a client-by-client basis, and prevent changes from being applied to clients whose returns were already filed.

With the box checked:

- Total unemployment compensation is still reported on Schedule 1, line 7;

- The Unemployment Compensation Exclusion Worksheet will calculate the amount of excludable income; and

- The excludable portion of unemployment will be included on Schedule 1, line 8, Other Income, as a negative amount with the description UCE.

The following deductions and exclusions are still calculated using the full unemployment compensation your client received:

- Taxable social security benefits

- IRA deduction

- Student loan interest deduction

- Tuition and fees deduction (Form 8917)

- Deduction of up to $25,000 for active participation in a passive rental real estate activity (Form 8582)

- Exclusion of interest from certain bonds (Form 8815)

- Exclusion of employer-provided adoption benefits (Form 8839)

When figuring these amounts, the program will use the amount from line 3 of the Unemployment Compensation Exclusion Worksheet when asked to enter an amount from Schedule 1, line 8. In effect, this adds back the excluded unemployment income to calculate MAGI for the specified items.

The UCE calculation, as well as the modification to calculating the above deductions, is based on the updated instructions for Schedule 1 issued by the IRS.

Suggestion ref. 55435

The following suggestion diagnostic will generate on returns with unemployment compensation when this box isn't checked:

The American Rescue Plan, enacted on March 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020 for returns with modified adjusted gross income (MAGI) less than $150,000. If married, each spouse receiving unemployment compensation gets the exclusion. To apply this provision, check the "Apply the American Rescue Plan Act provisions" checkbox in the Miscellaneous input screen. US-Ref #55435

To clear this diagnostic on returns not yet filed:

- Go to the Input Return tab.

- On the left-side menu, select General.

- Click on the Misc. Info./Direct Deposit screen.

- Select the Miscellaneous section along the top of the input screen.

- Check the box labeled Apply the American Rescue Plan Act provisions.

State return impacts

Different states already treated unemployment income in a variety of ways, and many states don’t conform to the new federal provision.

State treatment

California

California doesn’t tax unemployment income, so it’s already included as a subtraction on the Schedule CA. The amount of UCE claimed on the federal Schedule 1 is now included as an addition on the Schedule CA to avoid double-dipping.

New York

New York taxes unemployment income, and doesn't conform to the new provision, so the amount of UCE claimed on the federal Schedule 1 is added back on IT-558 using code A-011.

What about clients who already filed?

The IRS will automatically adjust most federal returns with unemployment income that were filed before the law change, and issue any additional refund directly to your client. See Common questions on the Unemployment Compensation Exclusion to check if your client needs to file an amended federal or state return.