Reporting the 2018 Domestic Production Activity Deduction from a specified cooperative in Lacerte

by Intuit•2• Updated 8 months ago

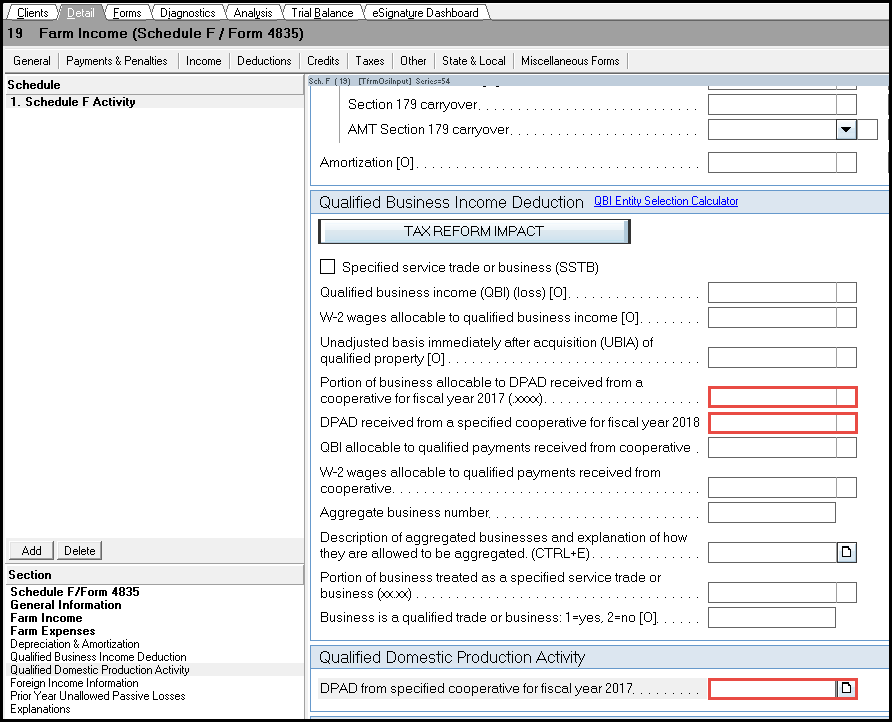

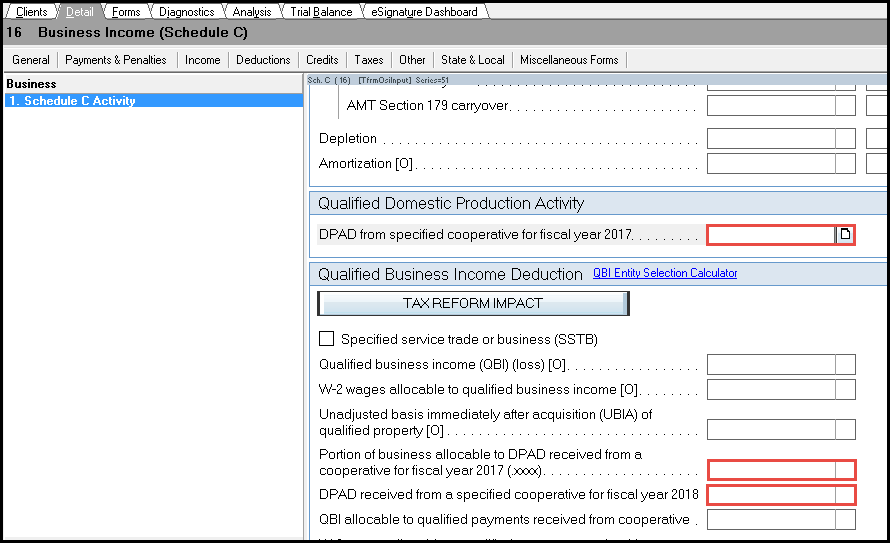

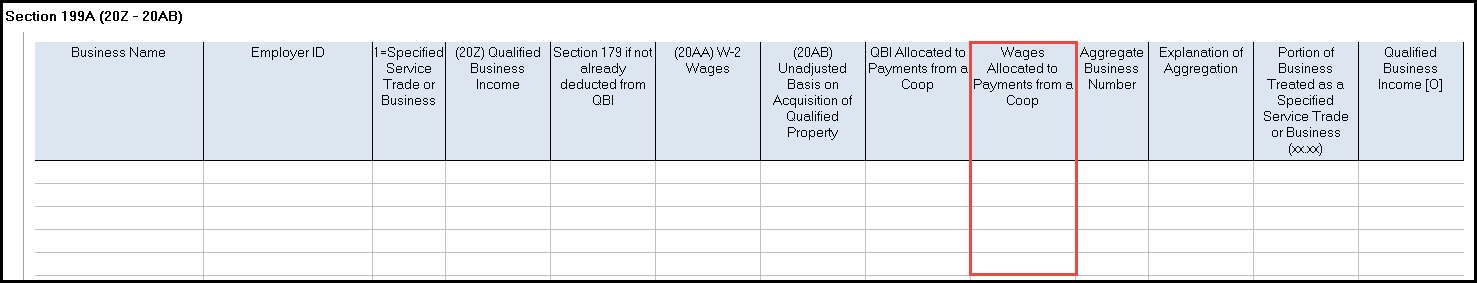

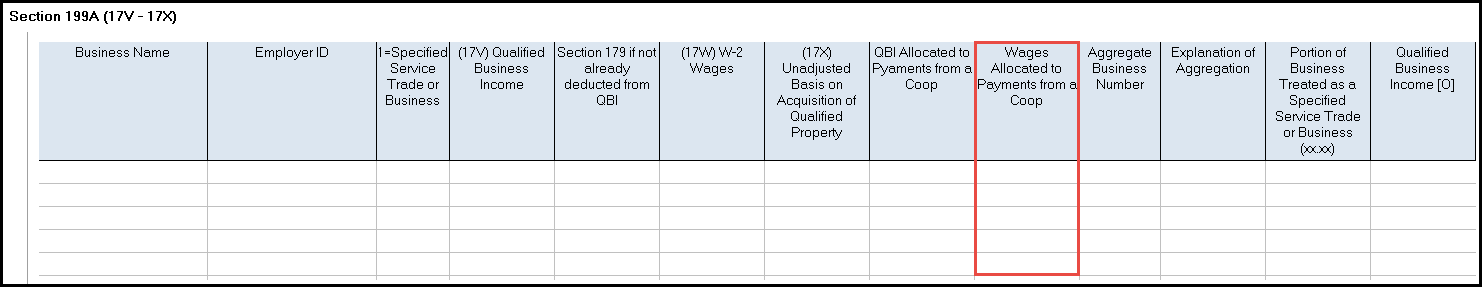

For tax year 2018, cooperatives with a fiscal year can receive the Domestic Production Activity Deduction (DPAD) passed through from a fiscal year 2017 cooperative, as well as the DPAD passed through from a fiscal year 2018 cooperative.

These two amounts are reported differently on Form 1040. Because of this, Lacerte includes two different input fields for these items within the Schedule C activity and Schedule F activity input screens.

Click the applicable screen below for more information.

Resources

Related topics

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Reporting the 2018 Domestic Production Activity Deduction from a specified cooperative in ProConnect Taxby Intuit

- Common questions about corporate Form 8903 qualified domestic production activity in Lacerteby Intuit

- Entering Form 1099-PATR in Lacerteby Intuit

- Entering Form 1099-PATR in ProConnect Taxby Intuit