Entering Form 1099-PATR in ProConnect Tax

by Intuit•2• Updated 9 months ago

Below, you'll find information on entering amounts reported on Form 1099-PATR, pertaining to Domestic Production Activities Tax Deduction for cooperatives, in Intuit ProConnect. Refer to the IRS Instructions for Form 1099-PATR for more information.

![]() Starting in tax year 2018, the Domestic Production Activities Deduction has been repealed. Form 1099-PATR now applies to cooperatives only.

Starting in tax year 2018, the Domestic Production Activities Deduction has been repealed. Form 1099-PATR now applies to cooperatives only.

When filing Form 1099-PATR, you may include distributions received from a cooperative to your income.

How to include backup withholding as income tax withheld

For an individual return:

- Go to the Input Return tab.

- From the left of the screen, select Income and choose SS Benefits, Alimony, Misc. Income.

- Under the Tax Withheld section, enter the backup withholding amount in the field labeled Federal Income Tax Withheld [Adjust].

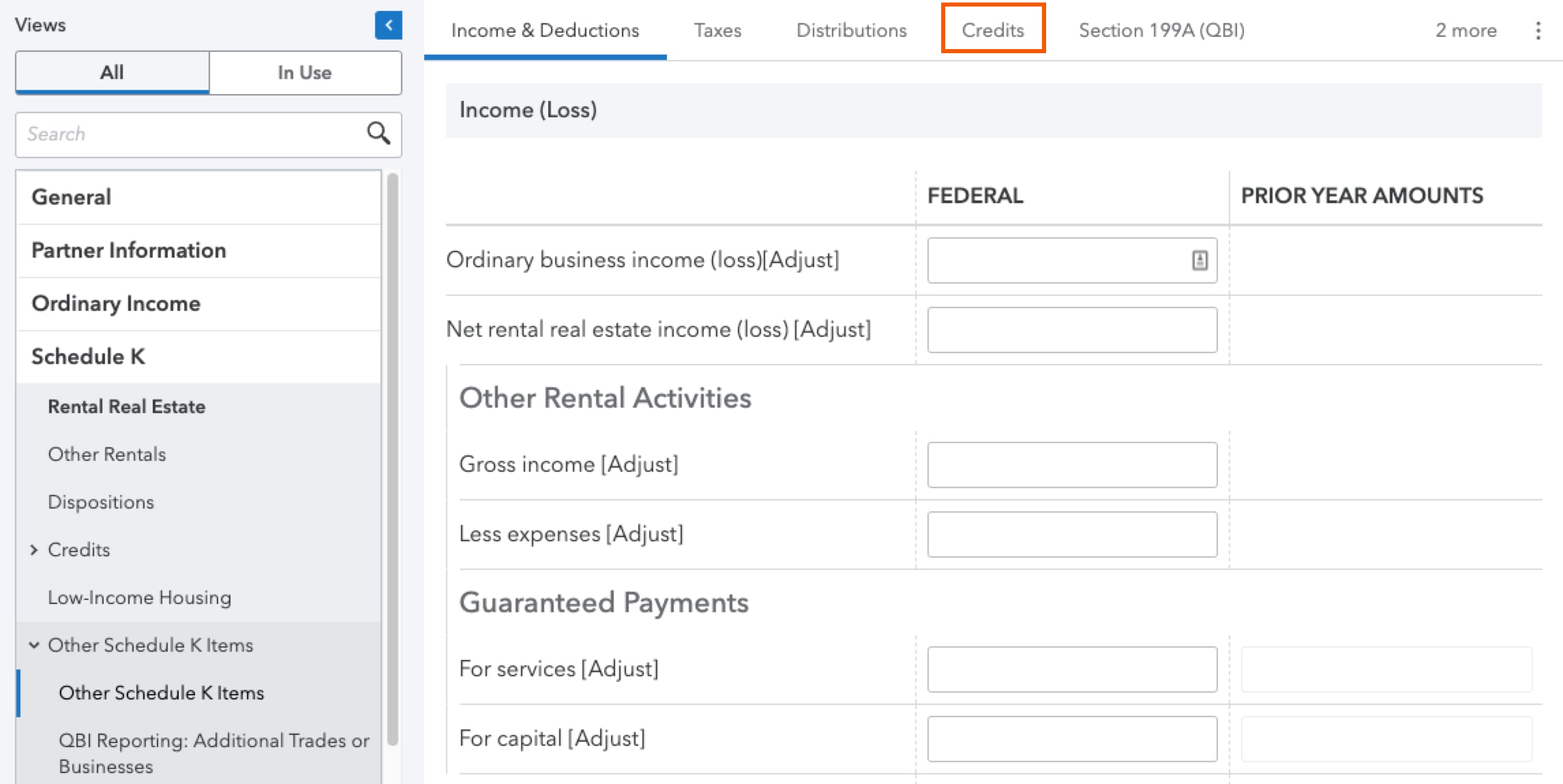

For a partnership return:

- Go to the Input Return tab.

- From the left of the screen, select Schedule K and choose Other Schedule K Items.

- Select Other Schedule K Items.

- From the top of the screen, select Credits.

- In the Other credits (Click on button to expand) field, select O = Backup withholding as the K-1 Code.

- This will appear on Line 15 of the Schedule K/K-1 (1065).

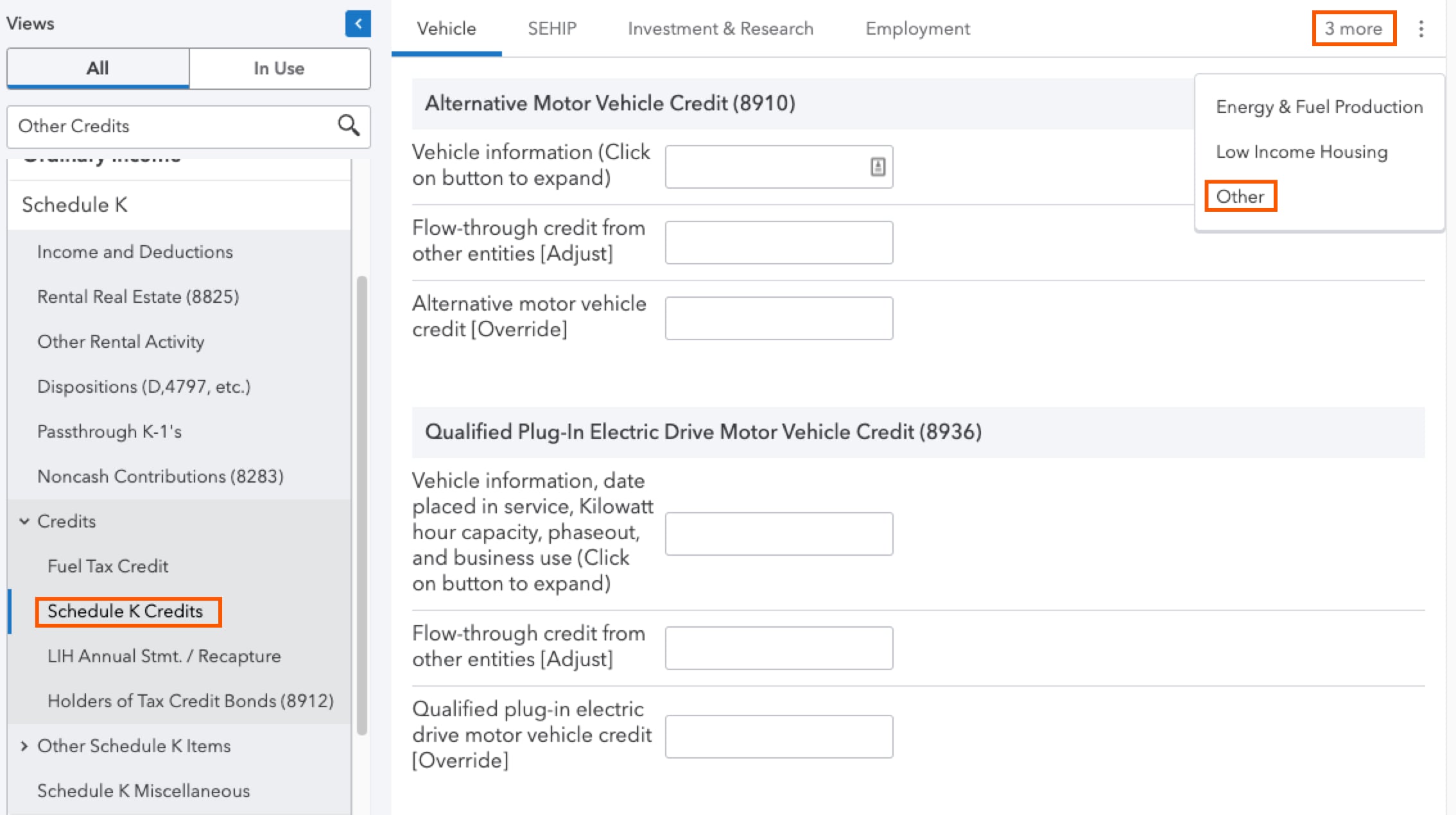

For an S-Corporate return:

- Go to the Input Return tab.

- From the left of the screen, select Schedule K and choose Credits.

- Select Schedule K Credits.

- From the top of the screen, click the three dots in the upper right corner and select Other

- Scroll down to the Other Credits - Schedule K Lines 13C - 13G section.

- In the Other credits (Click on button to expand) field, select O = Backup withholding as the K-1 Code.

- This will appear on Line 13 of the Schedule K/K-1 (1120-S).