How to resolve Wisconsin diagnostic Ref. 4773 for part-year and nonresident taxpayers

by Intuit•1• Updated 1 year ago

The following Wisconsin (WI) critical diagnostic may generate:

Part-year and nonresident taxpayers are not required to file Form 1NPR if gross income reportable to Wisconsin is less than $2000. Make an entry in "1=Wisconsin gross income requires filing of Form 1NPR" to force the calculation of Form 1NPR. (WI - Ref #4773)

How to generate Wisconsin Form 1NPR:

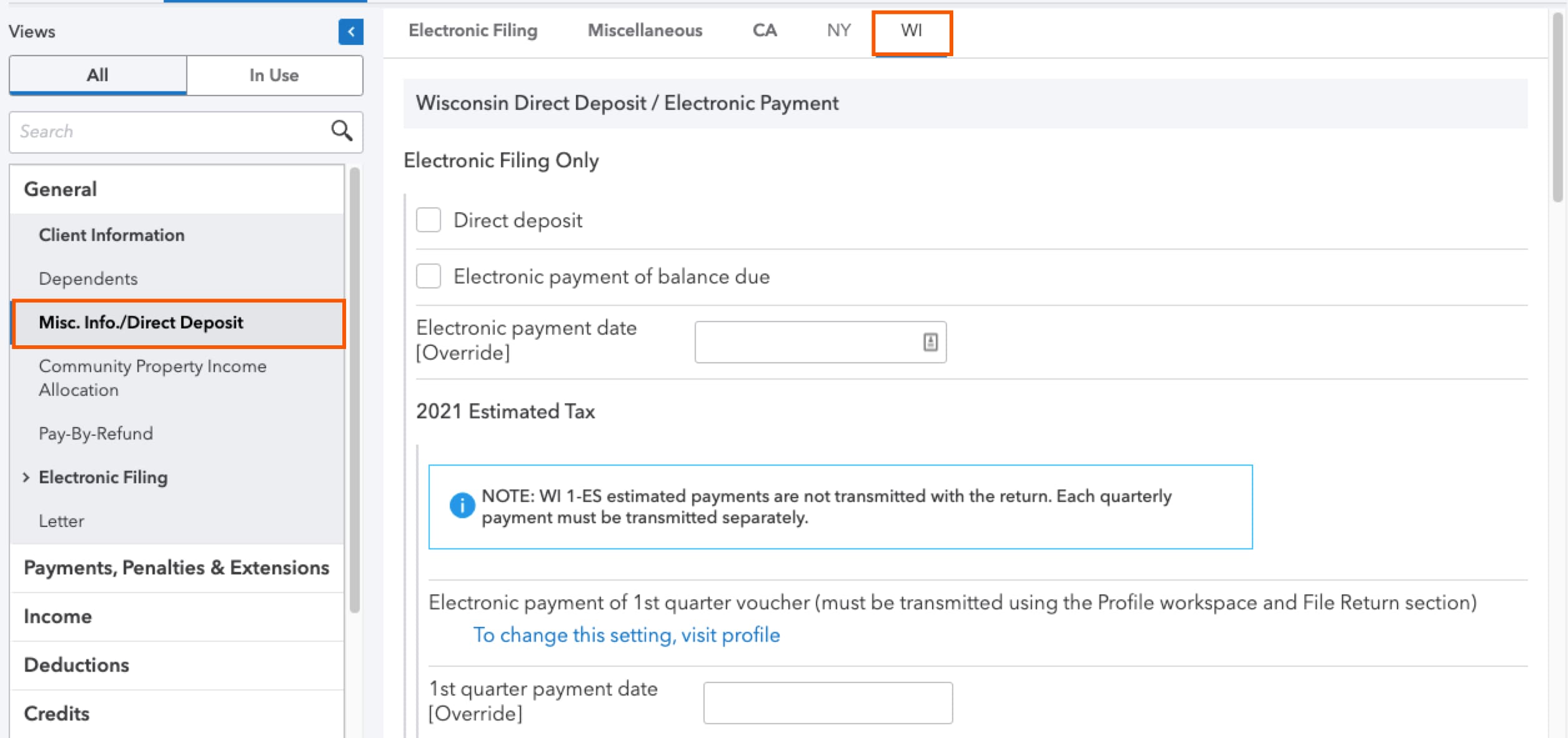

- Go to the Input Return tab.

- Select General.

- Select Misc. Info./Direct Deposit.

- Select the WI tab.

- Under Wisconsin Miscellaneous, select the box labeled Wisconsin gross income requires filing of Form 1NPR.

![]() If you select the box labeled Wisconsin gross income requires filing of Form 1NPR, the program will only generate WI Form 1NPR if you enter Wisconsin withholding on the return, even if the income is over $2,000.

If you select the box labeled Wisconsin gross income requires filing of Form 1NPR, the program will only generate WI Form 1NPR if you enter Wisconsin withholding on the return, even if the income is over $2,000.

You may file Form 1NPR if:

- You were a full-year resident of a reciprocal state (MN, MI, KY, IN or IL) and are only filing to obtain a refund of WI tax withheld in error from your wages.

- Your only income taxable to WI was from wages, salaries, tips, interest, and dividends.

- Your only deductions are the standard deduction and personal exemptions.

- You only qualify to claim the school property tax credit, armed forces member credit, working families credit, married couple credit, WI withholding, or estimated tax.

See the Wisconsin Department of Revenue for details.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- How to resolve ProConnect Tax diagnostic ref. #3393by Intuit

- How to resolve Lacerte diagnostic ref. 3393by Intuit

- How to resolve ProConnect Tax diagnostic Ref 47655 - Mississippi e-file generates when county is selectedby Intuit

- Common questions about individual District of Columbia Form D-30 in Lacerteby Intuit