Entering estimated tax on a multi-state individual return in Lacerte

by Intuit•2• Updated 2 months ago

For information on applying the One Big Beautiful Act provisions to tax year 2024 estimates see here, check out our Tax topics page on Estimated Tax payments where you'll find answers to the most commonly asked questions.

In this article, you can find information on how to enter each state's amounts of estimated tax when preparing a multi-state individual return for at least two different states.

Disaster area tax relief available:

Filing deadlines and estimated tax due dates may be extended for taxpayers in parts of Arkansas, California, Kentucky, Mississippi, Missouri, New Mexico, Oklahoma, Tennessee, West Virginia, and IRS for taxpayers living abroad. See here for more details.

To allocate each state correctly:

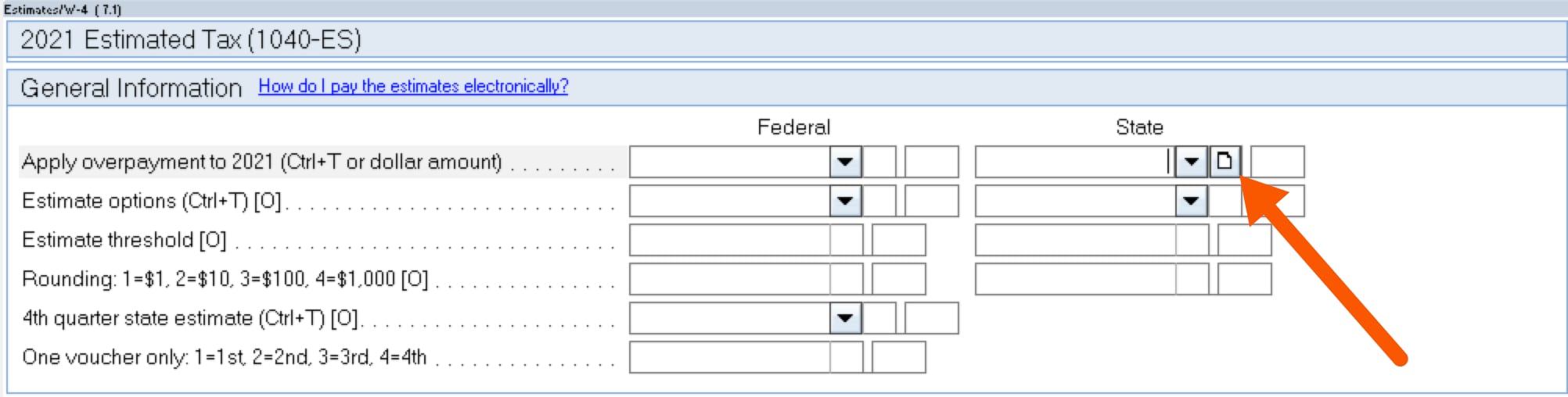

- Go to Screen 7, 2025 Estimates (1040-ES, W-4, W-4P).

- In General Information, under the State column, select the empty box next to the state dropdown menu.

- In the Allocate Multi-State Amounts window, enter the payment estimates for each state in the Amount field.

- Select the state initial from the State dropdown menu.

- Don't enter a Source code or the amounts won't flow to the state form.

- Select OK.

While the above steps will let the program allocate to each state correctly, you may want different amounts to be paid in each quarter than what the program calculates.

To enter the desired amount for each quarter:

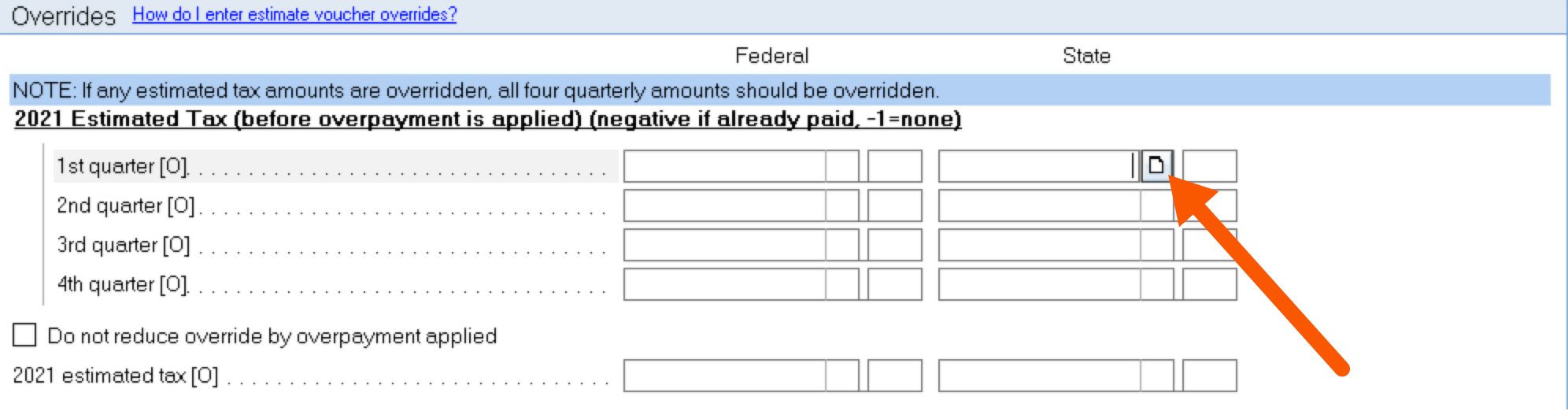

- Go to Screen 7.1, 2025 Estimates (1040-ES, W-4, W-4P).

- Scroll to the section Overrides.

- In the State column, select the empty box in the middle.

- In the Allocate Multi-State Amounts window, enter the payment estimates for each state in the Amount field.

- Don't enter a Source code or the amounts won't flow to the state form.

- Select OK.

![]() Enter a negative amount already paid, or -1 if there's no payment for that quarter. Select the box Do not reduce override by overpayment applied if applicable.

Enter a negative amount already paid, or -1 if there's no payment for that quarter. Select the box Do not reduce override by overpayment applied if applicable.

More like this

- Entering estimated tax on a multi-state individual return in ProConnect Taxby Intuit

- Common questions about individual Pennsylvania part-year resident returns in Lacerteby Intuit

- Common questions about Massachusetts Estimated Tax in Lacerteby Intuit

- Common questions about Form IT-201/IT-203 New York Estimated Payments in Lacerteby Intuit